Why Amazon doesn't worry about its lack of Alexa shoppers

Alexa will continue creeping into consumers' homes for the foreseeable future.

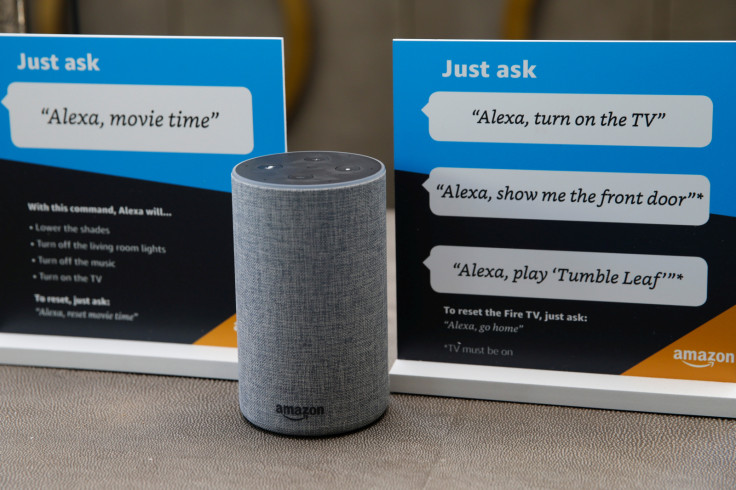

Amazon.com's (NASDAQ:AMZN) Echo speakers and Alexa devices are key components of the tech giant's expanding ecosystem, but not many people actually shop through the devices. The Information recently reported that only 2% of Alexa users have actually used the platform to buy products using voice commands.

This article originally appeared in the Motley Fool.

Moreover, about 90% of those users didn't use Alexa to buy products a second time. That sounds like dire news for Amazon -- but the company probably isn't too concerned, for four simple reasons.

1. People are still buying smart speakers

Amazon controlled 43.6% of the global smart speaker market in the first quarter of 2018, according to Strategy Analytics. Alphabet's (NASDAQ:GOOG) (NASDAQ:GOOGL) Google ranked second with a 26.5% share, followed by Alibaba's 7.6% share and Apple's 6% share.

Amazon has never disclosed its total number of Echo and Alexa shipments. But The Information, citing sources briefed on Amazon's internal data, claims that Amazon has sold about 50 million Alexa devices to date.

People are still using Alexa for other purposes, like getting weather and traffic updates, streaming music, answering questions, and controlling smart home devices like lights, locks, and thermostats. That's why Google, which lacks Amazon's e-commerce backbone, can still sell its speakers as home assistants.

The global smart speaker market is likely to expand at a compound annual growth rate of 31% between 2018 and 2023 to become a $19 billion market, according to Research and Markets -- leaving plenty of room for Amazon, Google, and Apple to thrive.

2. Alexa's ecosystem is still growing

Amazon states that third-party developers have already developed over 45,000 new skills for Alexa, up from 25,000 at the end of 2017. That growing skill set includes the ability to hail rides from Uber or Lyft, order food from Domino's, Starbucks, and GrubHub, and answer the door through Echo Show's Ring. These skills, along with Amazon's first-party services, keep users locked into Amazon's broader ecosystem.

3. Consumer habits are still evolving

Ideally, those Alexa users would place more voice orders on Amazon's marketplace. But consumer habits won't change overnight, and most shoppers aren't accustomed to buying things with voice commands.

However, 20% of Alexa's voice shoppers in The Information's study used the devices for broader shopping-related queries, like finding daily deals or tracking Amazon orders placed on other devices.

This indicates that although Alexa isn't a primary shopping platform yet, it still serves as an extension of Amazon's marketplace. Amazon's website and app are probably still better suited for browsing new products, while Alexa is optimized for placing repeat orders of prior purchases.

4. It's all about Amazon Prime

Amazon heavily promotes Echo devices on big shopping days like Prime Day, Black Friday, and Cyber Monday. That's because it wants to lock in users with those devices and convert its non-Prime members into Prime members. In April, Amazon revealed that it had surpassed 100 million Prime members worldwide, and hiked its annual fee from $99 to $119.

Non-Prime members can still use Alexa, but Alexa offers Prime members other perks like special discounts and the ability to play Amazon's streaming audio or videos on Fire TV devices. Earlier this year, research firm CIRP reported that Echo owners spent $1,700 annually on Amazon, compared to $1,300 for regular Prime members and $700 for non-members.

Thus, Echo owners might not be directly placing orders on their speakers, but they're still buying plenty of things from Amazon's marketplace.

The "voice shopping" market might be overrated

The Information's study suggests that growth forecasts for the "voice shopping" market might be too bullish. For example, OC&C Strategy Consultants has estimated that the voice shopping market in the U.S. and U.K. will grow from $2 billion today to over $40 billion by 2022.

Investors should take that forecast with a grain of salt. However, as an Amazon investor, I'm not concerned about the Alexa platform's lack of voice shoppers.

John Mackey, CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool's board of directors. Leo Sun owns shares of Amazon, Apple, and Grubhub. The Motley Fool owns shares of and recommends Alphabet (A shares), Alphabet (C shares), Amazon, Apple, and Starbucks. The Motley Fool is long January 2020 $150 calls on Apple and short January 2020 $155 calls on Apple. The Motley Fool has a disclosure policy.

© Copyright IBTimes 2025. All rights reserved.