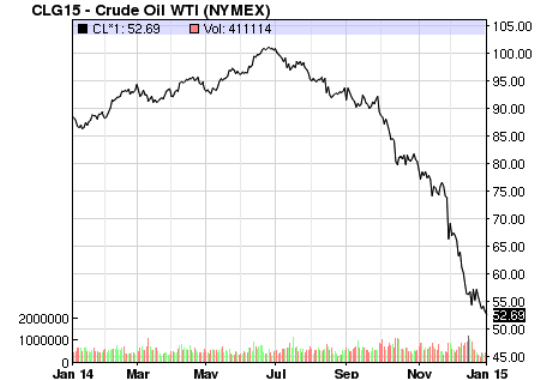

Crude oil rout persists on weak 2014 handover

Oil futures finish lower on 2 January, the first trading day of 2015

Crude oil futures traded lower on 2 January, the first trading day of the new year, pulled down by a stronger US dollar and concerns surrounding a global glut.

Brent February contract finished 91¢ lower at $56.42 a barrel on Friday.

US February contract finished 58¢, or 1.1%, lower at $52.69 a barrel, marking its lowest settlement since April 2009.

The ICE US dollar index was 0.9% stronger on Friday, hitting dollar-denominated oil.

Phil Flynn, senior market analyst at Price Futures Group, told MarketWatch that a weak euro versus the greenback played a key role in crude's move lower.

Flynn said remarks by ECB chief Mario Draghi that indicated the bank will implement quantitative easing sooner than later weighed on the euro, sending the currency to its lowest level versus the dollar since June 2010.

Meanwhile, Walter Zimmerman, chief technical analyst at United-ICAP told Reuters that the combination of the supply glut and the strong greenback has been a "double whammy" for crude oil prices.

Zimmerman said: "This is a long-term cyclical downtrend. It's going to take a while for prices to fall low enough to cut off that excess production."

Iran's deputy foreign minister Hossein Amir Abdollahian , on 1 January, urged fellow Opec member Saudi Arabia to take action to support oil prices, saying producer countries across the Middle East will be hurt unless the price slump was reversed.

Brent crude lost 48.26% through 2014 while US crude lost 45.87%.

Bank of Cyprus said in a 31 December note to clients: "As oil prices plunged, after [Opec] only confirmed the current quota and did not opt for production cuts to halt the drop in prices. With current supply running ahead of demand, a cut could have returned an element of balance to global oil markets.

"With a smaller market share, [Opec's] price-setting power has diminished. We think lower oil prices are beneficial for the global economy, on balance."

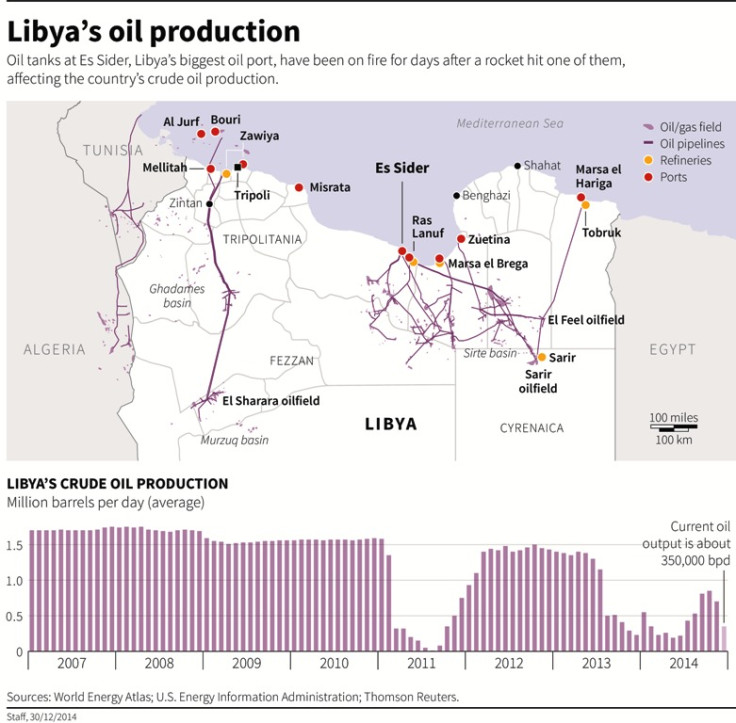

Opec members produced less oil in December than in the previous month.

The 122,000 barrels a day fall was the led by losses in Libya, where rebel militias have clashed close to the oil export hub of Ras Lanuf.

Production in the North African country has fallen by more than 300,000 barrels per day as a result, straining the nation's dollar currency reserves in the process.

© Copyright IBTimes 2025. All rights reserved.