FX outlook 2017: What does next year have in store for the pound and will we see euro/dollar parity?

The pound slumped and dollar spiked over 2016, so what can we expect from forex markets over the next 12 months?

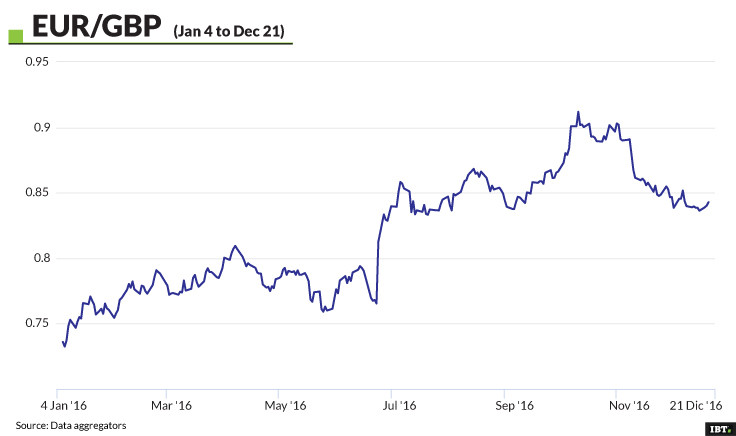

The pound plunged, the euro struggled and the dollar rallied. The one coming to an end was as eventful a year as traders could have wished for in the currency markets and, as 2017 approaches, there are more questions than answers on the horizon.

Sterling kicked off 2016 by closing the first session of the year at $1.4716, slightly down from the closing high of $1.5018 it recorded just a week before Christmas 2015. Thereafter, the UK currency enjoyed a relatively calm first half of the year, interrupted only by a brief foray below the $1.40 barrier in February.

As Britain's historic European Union referendum approached, sterling defied forecasts of impending economic gloom, climbing steadily, before suffering a dip below $1.42 at the beginning of June.

With Britons heading to the polls on 23 June, the UK currency reached the highest level in the year, climbing 0.9% against the US dollar, to rise to a year-high of $1.4877, just 24 hours after it hit its highest level against the greenback since 4 January.

That, however, was as good as it got for the pound, which suffered the third-biggest one-day decline of any currency in the world over the past 40 years the day following the EU vote.

The UK currency tumbled to its lowest level since 1975 after the Leave campaign secured a 52% to 48% win in the EU referendum, tumbling to $1.3228.

The slump was second only to the that caused by the Swiss central bank's unexpected decision to lift Switzerland's currency peg in January 2015 and by the turmoil that hit the Japanese yen during the 1973 oil crisis.

The pound closed the first post-referendum session at $1.3679, but the vote triggered a downturn that would see sterling slump approximately 19% in the three months following the referendum, with the UK currency hitting a 31-year low of $1.2123 on 11 October.

Two months earlier, the pound had fallen sharply after the Bank of England cut interest rates to a record low of 0.25% and unveiled a series of economic measures aimed at reviving the UK economy.

Sterling has since recouped some of the losses and looks poised to end 2016 between the $1.24 and $1.25 range, after hitting $1.2775 on 6 December, its highest level since 4 October. However, at the time of writing, it remains 12% and 15% lower than it was at the start of the year against the euro and the dollar respectively.

Sterling has also claimed the unwanted accolade of being the year's second-worst performer among major currencies, beaten only by the Mexican peso. The uncertainty surrounding the Brexit process has soured sentiment this year and could drag the currency even lower in 2017.

"The ongoing battle of words between financial heavyweights on the Brexit topic has added to the anxiety, while hard Brexit concerns continue to encourage sellers to incessantly offload the pound," said FXTM research analyst Lukman Otunuga.

"With the lack of direction in the UK government's Brexit stance compounding to the uncertainty, sterling could be poised for steeper declines moving forward."

However, BlackRock's deputy chief investment officer of global fundamental fixed income, Scott Thiel was more optimistic.

"So long as we don't go down the road of a hard Brexit, the pound will continue to react relatively favorably," he said.

The pound's post-Brexit plunge took the spotlight away from other troubled currencies, such as the euro, which might not have endured the struggle suffered by its British counterpart, but whose year was far from memorable.

Blighted by ongoing political uncertainty and a fledgling Eurozone economy, the common currency looks destined to reach parity against the greenback in 2017, after hitting $1.0353, the lowest level since early 2003 on 20 December.

The euro's downturn is made even more remarkable when one considers it reached its highest level this year on 2 May, trading at $1.1534, and was still trading as high as $1.1141 as late as 4 November.

The common currency's weakness has been exacerbated by the surging dollar, which over the last two months has put a lacklustre first half of the year behind it and ended the year on a high after the Federal Reserve lifted interest rates for the first time in a year.

The US central bank, which raise rates for the first time in nine years last December, hinted at three further hikes in 2017. The news, coupled with President-elect Donald Trump's pledge for significant investment next year, sparked the dollar into life, with analysts expecting the greenback to reach parity with the euro.

"It seems likely that the euro could well be about to have a crack through its floor of the last two years and revisit levels around parity last seen at the end of 2002, as the policy divergence between the ECB and the US Federal Reserve continues to widen," said Michael Hewson, chief market analyst at CMC Markets.

Jordan Hiscott, chief trader at Ayondo Markets added:"The last time the euro/dollar was at its current level it was 2003."

"More than 13 years later, the euro is now facing a perfect storm and the next obvious level is parity with the dollar, quite possibly by the second quarter next year."

Analysts also expect the dollar to break through the ¥120 barrier next year, a threshold it last breached in early February.

"The greenback has seen a stellar rally this year and it picked up, even more, steam since the US election," said Naeem Aslam, chief market analyst at Think Markets UK.

"Moreover, the Fed had said that they do see another three rate hikes next year which are only going to make the dollar-yen pair weaker."

© Copyright IBTimes 2025. All rights reserved.