India: Dismal Q3 earnings contradict GDP data and market rally

Earnings of India's largest companies missed expectations in the latest quarter, raising further doubt over official figures showing the nation's economic growth outpaced China's and over a stock market rally that kicked-off in early 2014.

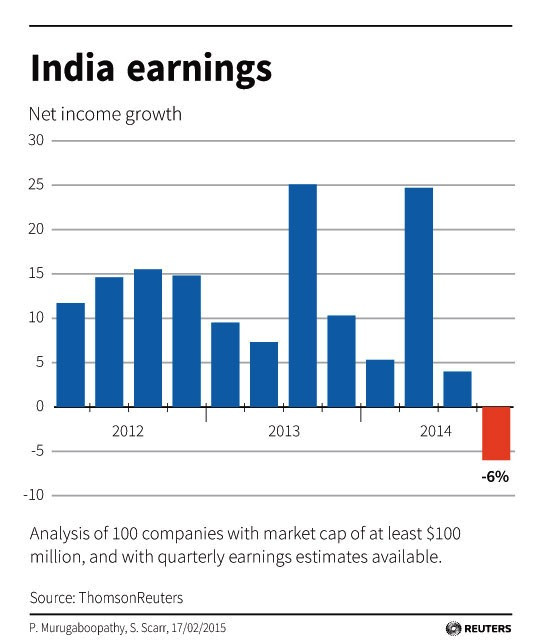

The combined net income of 100 firms with a market valuation of over $100m (£65m, €87m) dropped 6% in the third-quarter ended 31 December 2014, from a year ago, Reuters reported.

That compares with a 0.5% rise forecast by analysts tracking those companies.

It was also the first decline in at least 18 quarters since Thomson Reuters began recording data.

More than half of Indian firms missed earnings forecasts, including some of the biggest such as Reliance Industries, the operator of the world's biggest oil refining complex, JLR-parent Tata Motors and engineering giant Larsen & Toubro.

Analysts have, over the past month, cut their net profit forecasts for large and mid-sized Indian firms by 2.8% on average, according to Thomson Reuters data.

That's double the 1.4% cut in forecasts across the Asia-Pacific.

India, on 10 February, said its economy grew 7.5% during the October-December quarter from a year earlier, beating China's 7.3%, after government statisticians changed the way they calculate gross domestic product (GDP).

The December quarter marked the third straight quarter that firms' profits had failed to meet expectations, suggesting that they have disappointed ever since Prime Minister Narendra Modi was elected in May 2014.

His election victory had boosted optimism and drove equity prices to record highs.

© Copyright IBTimes 2025. All rights reserved.