Lloyd's of London Reveals Heightened Cyber Risk Boosts Profits

While it's been a relatively quiet year for Lloyd's of London in terms of natural disasters, notable claims have been made due to sudden and tragic aviation losses. Another area of risk that will grow and grow involves technology and the virtual business environment.

The Lloyd's of London insurance market, which reported profits of £1.67bn ($2.71bn, €2.14bn) on 25 September 2014, comprises a number of underwriting syndicates that specialise in cyber risk and technology.

Announcing the results, Lloyd's chief executive Inga Beale described the process of insuring the virtual world as a co-mingling of science and art.

The corporate universe can save a fortune by migrating to cloud storage services, however the security risks attached to such protocols were well publicised lately. Also in the headlines recently is Bash – the putative mother of computer viruses.

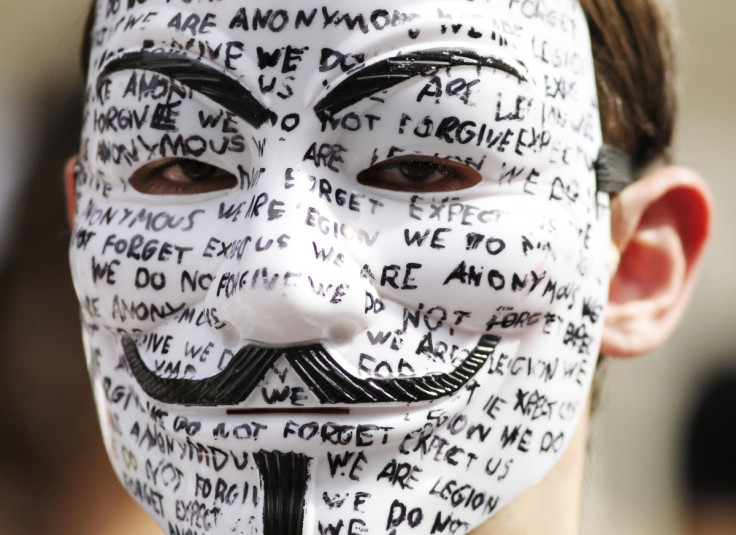

"That is the sexy end of our business and there is no doubt hackers and viruses in the media drive a lot of the business," said Jayne Goddard, an underwriter specialising in Cyber, Technology and Media, Barbican Insurance Group to IBTimes UK.

"Only between 10% and 11% of losses come from actual malware and hacking. Obviously hackers pose a big risk to companies that have lots of credit card records, for instance. But the majority of losses can be attributed to human error – losing laptops or smartphones, or sending data places that you shouldn't.

"There is a lot more in our policies. We would look at employees' behaviour and how they are trained. There is also the question of people deliberately leaking data, especially if they are disgruntled and are leaving a company," adds Goddard.

The cyber insurance business is different from the property business – it's both property and liability, explains Geoff White, underwriting manager, Cyber, Technology and Media, Barbican.

Relating cyber-business to the rest of Lloyd's market, White said to IBTimes UK: "With property you get a quick turn around but with liability it can take three or four years to come through from a data breach. It takes time to notify parties then longer to take decisions."

From a liability perspective, Lloyd's saw £75m of cyber-business in 2013. This year it estimates £150m, net of brokers' commissions.

The risk from cybercrime has increased exponentially.

As White points out, "10 or 15 years ago the easiest way to steal money from you was to break into your house or physically steal it. Now that we do lots of transactions online it's easier to steal money virtually.

"If you bank with a smartphone and if you leave your Wi-Fi open, let's say, then I can set up a dummy Wi-Fi network and name it something enticing or appropriate to you. I could then plant malware on your phone which could use your password to transfer money from your account."

This commonplace risk has become familiar to the business world. "In terms of business types, we see a lot of tech firms, a lot of financial firms, and a lot retailers, especially after breaches in US."

In terms of breakdown, 85% of this is US-domiciled and the other 15% is the rest of the world.

White states that for US-domiciled risks the available capacity in the London market exceeds £120m; for UK-domiciled risks this increases to over £200m. The premiums depend on the sector.

White adds: "We are looking to understand company exposures so we can charge premiums that are appropriate. We are writing 10 times more business than two years ago."

The US cyber-insurance market was worth about £524m and reached £739m last year. It is expected to reach £1.5bn in revenue this year.

The UK market is expected to grow to £450m by 2019.

A UK government survey found that 87% of SMEs and 93% of larger firms indicated data breaches in 2012.

© Copyright IBTimes 2025. All rights reserved.