Petropavlovsk to Report Record Growth Phase as Production Levels Soar

Petropavlovsk, the Russian gold exploration company, has increased the production target for the FY 2012 by 11 percent to 680,000oz compared to FY 2011 and a compounded yearly growth rate of 26 percent since the group first listed in 2002.

The production target considers the commissioning of the new milling line at Malomir in July 2011 and of Albyn in November 2011, the optimisation of the mining schedules following latest additions to its reserves and resources base, its fresh approaches to mine planning and production forecasting adopted in the fourth quarter of last year.

But the target does not consider the decision to move forward the planned extension of Pioneer and Albyn to Q3 2012 from 2014.

In line with the prior year, Petropavlovsk is set to publish a mine-by-mine production breakdown together with its preliminary results on March 28.

Commenting on the group's full-year trading, CEO Sergey Ermolenko said: "2011 was a successful year for the group. 2012 is poised to be another milestone year in the development of the group. It will see the commissioning of the previously mentioned additional RIP circuit at Albyn and the fourth circuit at Pioneer as well as the flotation plant at Malomir. I am confident in our ability to develop our POX hub at Pokrovskiy in line with the targets we have set ourselves. I look forward to updating shareholders on the development of this exciting new growth phase in the group's history later on in the year. We expect all the main inflationary pressures which were prevalent during 2011 to continue into 2012. Together with the scheduled decline of grades at all our mines, they are expected to result in some further increases to the group's costs of production. The group's management will continue to focus on our cost control programme which was successfully implemented during 2011."

According to the Petropavlovsk's trading update for the year ended December 31, 2011, its total attributable gold production increased by 24 percent to 630,100oz, beating its full year production guidance of 600,000oz given at the start of the year.

During the year, the group's total gold sold was 676,000oz, up 51 per cent compared to 2010. The robust sales figures reflect the large quantity of gold sold at the beginning of the year as a result of the company's high production levels in the fourth quarter of FY 2010.

"We expect these results will be well received by the market, boosting confidence in the group's ability to deliver," said analysts from Collins Stewart in a note.

While Citi added: "With this result Petropavlovsk has demonstrated that it can meet and exceed its targets."

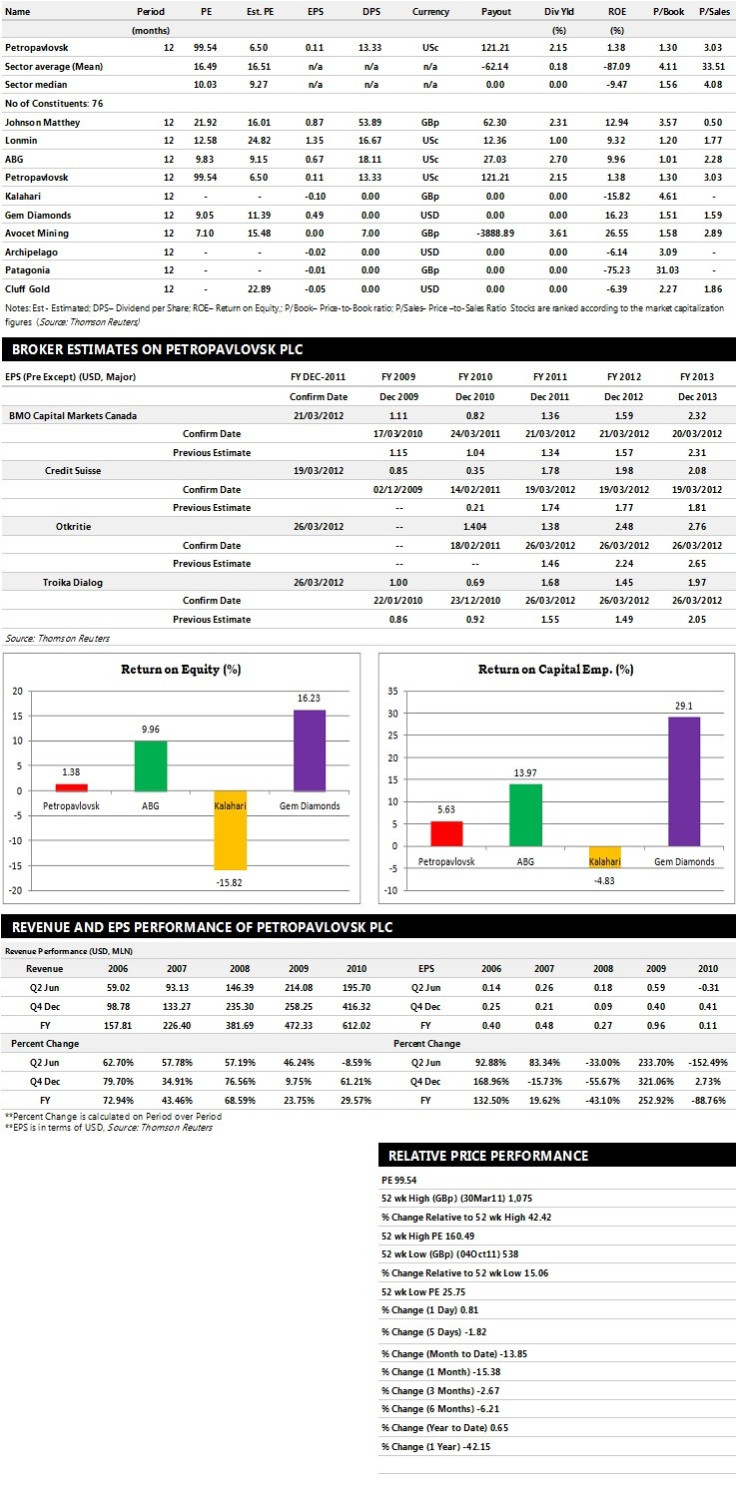

Below is a summary of sector comparisons in terms of price earnings, earnings per share, dividend per share, dividend yields, return on equity and price-to-book ratio. The table explains how the company is performing against its peers/competitors in the sector.The table below represents top ten companies based on market capitalisation.

Brokers' Views:

- Troika Dialog recommends 'Buy' rating on the stock with a target price of $16.27 per share

- Otkritie assigns 'Buy' rating with a target price of $13.00 per share

- BMO Capital Markets Canada gives 'Market perform' rating with a target price of $9.88 per share

- Credit Suisse assigns 'Neutral' rating with a target price of $14.41 per share.

Earnings Outlook:

- Troika Dialog estimates the company to report revenues of $1,261.00 million and $1,341.00 million for the FY 2011 and FY 2012 respectively with pre-tax profits (pre-except) of $436.00 million and $359.00 million. Earnings per share are projected at $1.68 for FY 2011 and $1.45 for FY 12.

- Otkritie projects the company to record revenues of $1,215.00 million for the FY 2011 and $1,527.00 million for the FY 2012 with pre-tax profits (pre-except) of $349.00 million and $589.00 million respectively. Profit per share is estimated at $1.38 and $2.48 for the same periods.

- BMO Capital Markets Canada expects the group to earn revenues of $1,207.00 million for the FY 2011 and $1,271.00 million for the FY 2012 with pre-tax profits of $365.40 million and $412.70 million respectively. EPS is projected at $1.36 for FY 2011 and $1.59 for FY 2012.

© Copyright IBTimes 2025. All rights reserved.