Royal Mail Shares: Why Vince Cable's Privatisation is a Success

It was a hasty sale that lined the pockets of bankers and desecrated one of Britain's most historic public institutions by handing it over to the profiteering private sector at an outrageous discount.

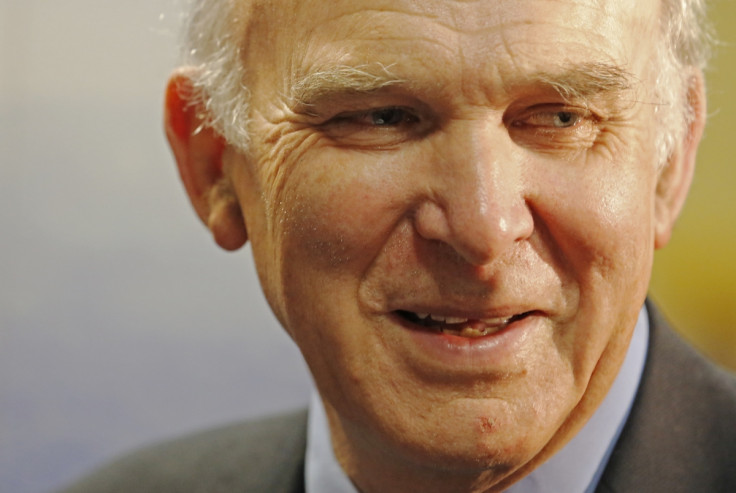

Such is the view of many who opposed the sell-off of communications firm Royal Mail, led by Business Secretary Vince Cable.

But amid a rough consensus that the government botched its privatisation by listing the shares too cheaply – a view supported by a National Audit Office report – there is also dissent.

"The sale of Royal Mail was well handled," said Dr Masden Pirie, president of pro-free market thinktank the Adam Smith Institute (ASI).

"It was the first major privatisation in two decades, and the aim was not to raise the greatest possible sum for the government, but to turn a state-run corporation into a successful and flourishing private business."

When the government set the 330p offer price for Royal Mail shares it was following advice from investment banks Goldman Sachs and UBS.

Since the October 2013 flotation onto the London Stock Exchange, the shares have settled at around 565p – a 71% increase. Some banks have issued research notes putting the target price much higher.

Interestingly, Goldman Sachs analysts – who banking regulations dictate must be separated from the advisory division by a 'Chinese Wall' – put their target price at 610p. UBS analysts opted for a much lower 450p.

"No-one knew what the 'correct' price was for Royal Mail, any more than they did for BT, British Gas and the dozens of others," said ASI's Pirie.

"Since they had not traded in the private sector, or had to attract private investment, no-one knew how they would be valued.

"Government took expert advice knowing that it would be, at best, an estimate."

Pirie noted that the government "covered itself" by retaining a 30% stake in Royal Mail.

"The government was right to be cautious in the sale of Royal Mail," said Mark Littlewood, director general at the pro-market Institute of Economic Affairs (IEA) thinktank.

"It is impossible to know the right price for something in the absence of a market. Had politicians taken too great a risk, the backlash had there been unsold shares would have been substantially greater.

"Whilst the Royal Mail sell off may not have been perfect, its benefits are huge. For too long our postal service has failed to innovate and modernise. This move to the private sector will see a service with better incentives and controls, providing a more successful and less wasteful postal service.

He added: "And 700,000 private investors, including many postal workers, have made money at very little risk. That is by no means a failure."

Of the share offer, 10% went to postal workers meaning many Royal Mail employees now hold a direct financial stake in the business. They will benefit from a rising share price when they eventually cash in.

The Institute of Directors (IoD), a members body for company executives, also backed the government's approach to the sale.

"The privatisation of Royal Mail should be seen as good for the business, good for taxpayers, and good for hundreds of thousands of new shareholders, particularly the many members of staff who now own part of the company," said Simon Walker, the IoD's director general, adding that the government should sell the rest of its remaining stake.

© Copyright IBTimes 2025. All rights reserved.