Samsung Pay: Mobile payment service records $16.8m loss in maiden year but company is not worried

Samsung Pay, the Korean company's mobile payment service that has been in operation for less than a year, has reported a loss of $16.8m (£11.8m) until now. Samsung Electronics, however, said it was not at all worried and viewed the platform as an investment for the future that will strengthen the competitive edge for Galaxy smartphones.

"Samsung's pragmatism does not stop on just simply selling one-time hardware, but it is going to actively push for M&A and make investments if it sees businesses that can continuously create profits," said a high-ranking official from Samsung regarding Samsung Pay.

Samsung's audit report for 2015 shows Samsung Pay recorded sales of $4.12m and a net loss of $16.8m with its debt and net worth being $23.6m and $10.5m respectively. What Samsung is branding as Samsung Pay now is in fact the former LoopPay, which the company bought for $229m in February 2015 and relaunched in August of the same year as Samsung Pay.

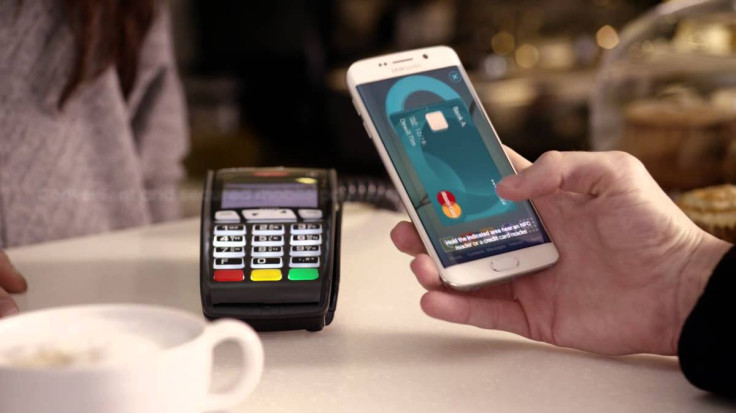

Currently, Samsung Pay is supported by Galaxy S6, S6 Edge, Note 5 and several Galaxy A phones along with the freshly launched Galaxy S7 and S7 Edge. It works for these users with no extra cost and Samsung confirmed that it has no plans to impose any commission on using the service to push for profits as of now.

Samsung Pay vs Apple Pay

Although Samsung Pay now supports payment cards from 70 financial institutions in the United States, which represents 70% of the debit and credit card market, it lacks the widespread card support of Apple Pay whose list of accepted banks is now over 1,000, covering a much larger portion of the market. Samsung Pay, however, still holds the title of "the most widely accepted payment system."

A major reason for this is the magnetic stripe emulation (MST) that is both unique and valuable in the US making the mobile payment system compatible with most credit card terminals on the market as EMV chip readers and magnetic strip readers. Bloomberg reported that Samsung Pay is currently growing faster than Apple's payment service, which had a head start in the early days.

Even when one goes beyond the US, Samsung Pay has a far better reach with the company recently claiming that since SamsungPay service was started in August of last year, there were a total of $500m in accumulated payments and 5 million accumulated members until February 2016. Of these, more than one million users were from South Korea alone. Further, Samsung has recently launched Samsung Pay in China where the mobile payment market is well established, and has plans to launch in Australia, Brazil, Singapore, Spain and the UKby the end of this year.

© Copyright IBTimes 2025. All rights reserved.