What is Samsung Pay and when is it coming to the UK? Everything you need to know

Samsung Pay has just launched in the company's native South Korea. It will go up against Apple Pay and a mobile payment system coming from Google later in the year. Here is everything you need to know.

What is Samsung Pay?

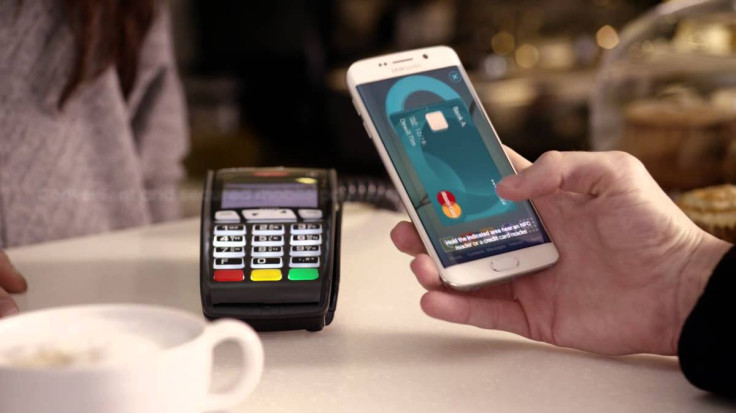

Samsung Pay is a mobile payment system which lets you buy goods by tapping your phone against the card reader in a shop or restaurant instead of using your credit or debit card. Payments are authorised when the owner of the phone presses against the phone's fingerprint reader, or enters a PIN. Samsung Pay is available in South Korea now and will be arriving in the US on 28 September. Samsung has suggested that it will expands to the UK, Spain and China in the near-future.

Credit and debit cards from banks and card issues who have partnered with Samsung can be uploaded to your phone, just as they can with Apple Pay.

Which phones work with Samsung Pay?

Samsung Pay only works on the company's newest Android handsets; the Galaxy S6, S6 Edge and newly announced S6 Edge Plus, as well as the new Galaxy Note 5. It would be safe to assume Samsung Pay will be standard on all future Samsung flagships, but how far down the hierarchy the service goes remains to be seen.

What makes Samsung Pay different from Apple Pay?

Where Apple Pay only works with card machines equipped with a contactless card reader, Samsung Pay uses a second technology to process payments through the older magnetic stripe readers too, which are still popular in the US and Asia. This will be big news for the US market, where chip & PIN is still being rolled out and contactless cards are much less common than in the UK, which has had them for a couple of years.

To do this, Samsung uses electronic signals produced by the phone to trick the reader into thinking it has received a signal from a magnetic stripe card. The technology is called Magnetic Secure Transmission (MST) and comes from Samsung's purchase of LoopPay, a company which tried to pioneer the payment method with compatible smartphone cases. With Samsung Pay using MST, retailers will not need to upgrade their hardware to accept payments.

How much can I spend with Samsung Pay?

When Samsung Pay comes to the UK it will have to comply with the same general restrictions as Apple and all card providers. This means payments are limited in most instances to no more than £20 now, with the limit rising to £30 (providing retailers upgrade their contactless card readers) in September. Higher limits are possible, however, even now, but that depends on individual deals being struck between retailers and Apple/Samsung.

Will all UK banks get on board with Samsung Pay?

Almost certainly – but perhaps not from day one. As we have seen with Apple Pay, while the card issues (Mastercard, Visa, American Express) were all signed up and ready to go when the service went live, the banks are more hesitant. Lloyds Bank and TSB are yet to offer Apple Pay – although both say the service is coming to their customers soon – and Barclaycard is trying its own thing with bPay, a range of contactless payment accessories.

But once they have all joined Apple Pay, we expect the transition to both Samsung Pay and Android Pay to be a smoother process. The same goes for retailers, who are slowly getting onboard with Apple in the weeks and months since it went live.

The only question left, is will consumers ever see paying with their phone as more than a novelty?

© Copyright IBTimes 2025. All rights reserved.