Trump Says There May Be No 'Income Tax to Pay' as POTUS Boasts Tariff Numbers

Donald Trump floated the idea of no longer paying income tax due to high tariff revenue.

US President Donald Trump has suggested that American citizens may no longer be required to pay income tax in the near future, asserting that surging revenue from import tariffs could fully replace the federal levy.

The remarks, delivered during a press briefing at the White House, mark a significant escalation in the administration's protectionist economic rhetoric, despite official data showing a massive disparity between tariff income and the budgetary needs of the US government.

The President's Vision

Speaking to reporters, Trump touted the administration's recent collection figures, citing $215 billion (£170 billion) in tariff revenue.

'I believe that at some point in the not too distant future you won't even have income tax to pay,' said Trump. 'Because the money we're taking in is so great, so enormous, that you're not gonna have income tax to pay. Whether you get rid of it or just keep it around for fun, or have it really low, much lower than it is now, that you won't be paying income tax.'

This proposal represents a desire to return the US to a pre-1913 tax structure, prior to the ratification of the 16th Amendment, when the federal government was primarily funded by excise taxes and customs duties. The US leader has often repeated this claim in public appearances, telling his supporters that as long as tariff revenue continues to go up, income tax may be cut.

@whatssnewss Trump: "I believe that at some point in the not too distant future you won't even have income tax to pay. . #news #trump #maga #taxes

♬ Originalton - Whats News

From Federal Income Tax to Import Tariffs

Trump and his administration have long sought to prove that the country can move from taxing income to imposing import tariffs. The US leader has often repeated this claim in public appearances, telling his supporters that as long as tariff revenue continues to go up, income tax may be cut. Trump has even hinted that the usual tax on wages can be cut out completely if the strategy proves to be successful.

For the US leader's allies, the strategy is framed as a populist reset of the federal tax code. They have argued that foreign imports and foreign governments could shoulder more of the costs to keep Washington going.

What Experts Say

Economists have reacted with scepticism, warning that the burden of tariffs falls on domestic consumers rather than foreign entities.

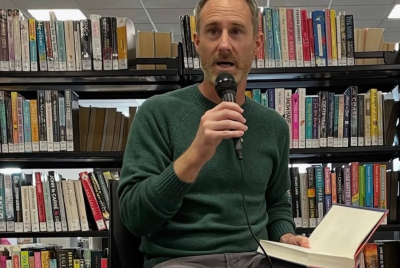

Justin Wolfers, a professor of economics and public policy at the University of Michigan, said Trump's claims were 'nonsense.' During an appearance on The Weekend on MS NOW, Wolfers was asked for comment on the feasibility of linking federal income tax to the rising tariff revenues.

'My kids don't even lie that often,' Wolfers said Saturday. 'I just feel disappointment and a certain sadness at this point.'

'This is just nonsense. Let me start with one important fact-check: The president appears not to understand the difference between millions, billions, and trillions. That's actually one of the most important points in all of economics; They're massively different. We are not taking in trillions of dollars in tariff revenue,' said Wolfers. 'If we were, we could afford his $2000 (around £1,514.37) tariff checks. We aren't, so therefore, we can't.'

Market Performance Context

Wolfers particularly cited Trump's boast during his remarks in Mar-a-Lago that the US is raking in trillions in tariff revenues in terms of percentage growth.

'If you look at the stock market returns from, say, 25 of the biggest countries around the world, the United States ranks about 22nd right now. So yes, American stocks are up. But guess what? They're up even more everywhere else,' said Wolfers.

The debate underscores a fundamental clash between the administration's protectionist ideology and the established principles of global economics. While the promise of a tax-free future resonates with the electorate, the arithmetic required to achieve it remains elusive.

© Copyright IBTimes 2025. All rights reserved.