Ashtead Group in Top Brokers 'Buy' List; Positive on Beating FY Expectations

Ashtead Group, the investment holding and management company, remains confident over the outlook for end construction markets in the short-term, particularly in the UK. Ahead of Q3 results on March 6, the group has secured 'Buy' ratings from Jefferies, Peel Hunt and Numis Securities.

The group continues to benefit from the structural shift to rental, market share gains and the improvements it has established in all key areas of its business. Together with its balance sheet strength and strong market positions, Ashtead is confident of delivering another year of good progress.

The equipment rental group expects the UK construction market to be difficult for some years and is confident that it will follow the US into cyclical recovery in due course. Equipment rental remains a comparatively new industry and it is still a relatively young company. The group believes there are significant opportunities especially in the US where rental penetration remains at around only 40% but growing compared to the 70-75% penetration in the more mature UK market. Ashtead is determined to take maximum advantage of the next cycle and of the network, fleet, finances and human capital that it has preserved through the recession.

During the half year and second quarter ended 31 October 2011, the group reported record first half pre-tax profits of £84m in end markets which remained well below previous peaks. Market share gains, the ongoing structural shift to rental in the US and operational efficiency meant it delivered a very strong performance across a broad range of metrics despite end construction markets being at a cyclical low point. This is encouraging for both the short-term, where it expects a continuation of current trends, and the longer term where, when cyclical recovery comes, it expects to benefit significantly.

The equipment rental group which provides apparatus that lifts, powers, generates, moves, digs, supports, scrubs, pumps, directs, ventilates, in November, 2011 saw both Sunbelt and A-Plant deliver good year-on-year revenue and profit growth continuing the pattern established in the second half. With its healthy debt structure, considerable capacity to fund fleet growth and the well-established momentum in its business, it now anticipates a full year profit substantially ahead of its expectations.

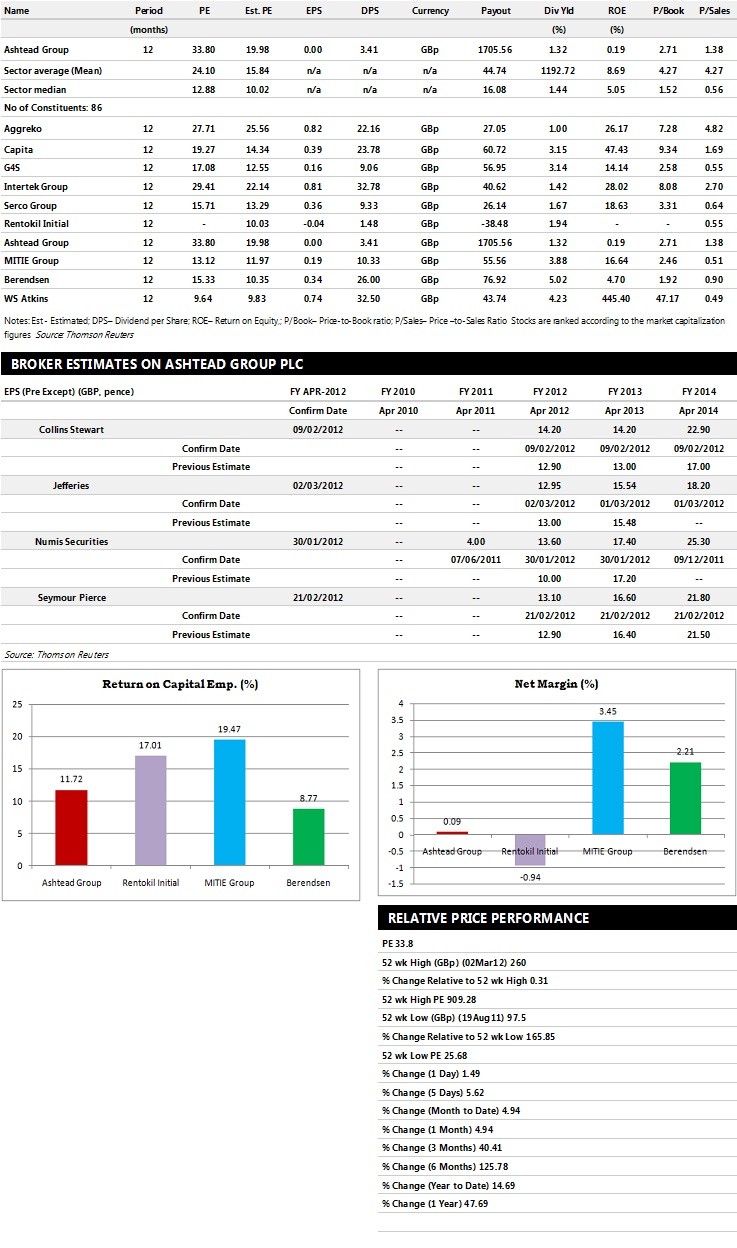

Brokers' Estimates:

- Jefferies gives 'Buy' rating on the stock with a target price of 285 pence per share

- Peel Hunt recommends 'Buy' rating with a target price of 275 pence per share

- Seymour Pierce assigns 'Buy' rating on the stock with a target price of 300 pence per share

- Collins Stewart assigns 'Hold' rating

- Numis Securities recommends 'Buy' rating with a target price of 293 pence per share

Earnings Outlook:

- Jefferies estimates the company to report revenues of £1,081.60 million and £1,132.00 million for the FY 2012 and FY 2013 respectively with pre-tax profits (pre-except) of £100.40 million and £120.60 million. Profit per share is projected at 12.95 pence for FY 2012 and 15.54 pence for FY 2013.

- Seymour Pierce projects the company to record revenues of £1,078.30 million and £1,174.90 million for the FY 2012 and FY 2013 respectively with pre-tax profits (pre-except) of £102.20 million and £127.40 million. Earnings per share are estimated at 13.10 pence for FY 2012 and 16.60 pence for FY 2013.

- Collins Stewart expects Ashtead to earn revenues of £1,089 million for the FY 2012 and FY 2013 with pre-tax profits of £110.10 million for both the periods. EPS is estimated at 14.20 pence for FY 2012 and FY 2013.

Below is a summary of sector comparisons in terms of price earnings, earnings per share, dividend per share, dividend yields, return on equity and price-to-book ratio. The table explains how the company is performing against its peers/competitors in the sector. The table below represents top 10 companies based on market capitalisation.

© Copyright IBTimes 2025. All rights reserved.