Bitcoin Bounces Back 10% as Industry Rounds on Mt. Gox

Bitcoin prices have gained more than 10% after members of the digital currency industry leapt to its defence, claiming the dramatic fall in its value yesterday was solely attributable to the failings in the now-defunct Mt. Gox exchange.

Opening at $534.71 on 26 February, bitcoin rose as high as $593.25 (£355.72, €431.68), up 10.95% or $58.54 as at 7:00 am GMT, according to the CoinDesk bitcoin price index.

Although many critics have claimed yesterday's plunge demonstrates the inherent volatility of bitcoin, a statement by industry leaders pinned the blame solely on Mt. Gox, lamenting its "complacency" and "shameful legacy".

The statement, whose signees included Coinbase founders Fred Ehrsam and Brian Armstrong and Blockchain CEO Nicolas Cary, said: "This tragic violation of the trust of users of Mt. Gox was the result of one company's actions and does not reflect the resilience or value of bitcoin and the digital currency industry.

"Strong bitcoin companies, led by highly competent teams and backed by credible investors, will continue to thrive, and to fulfill the promise that bitcoin offers as the future of payment in the Internet age."

'The protocol and fundamentals remain unchanged'

Michael Jackson, partner at Mangrove Capital Partners, echoed the industry leaders' sentiments, saying in an e-mail to IBTimes UK: "The death of Mt. Gox has been caused by poor implementation, rather than fundamental issues to the protocol."

This tragic violation of the trust of users of Mt. Gox was the result of one company's actions and does not reflect the resilience or value of bitcoin and the digital currency industry.

Jackson added that bitcoin is likely to be "enhanced or further developed to add end-user protections at the expense of anonymity". He noted that the industry will be adapting to the needs of depositor protection, as "virtual currency operators move away from idealism towards practicality".

Meanwhile, Jordan Kelley, CEO of bitcoin ATMs maker Robocoin, said that the failure of Mt. Gox marks the end of bitcoin's youth, adding that new bitcoin companies are providing institutional-grade consumer protection at present.

"Bitcoin is robust and resilient. The protocol and fundamentals remain unchanged. Its businessmen and engineers are building tools to give consumers confidence that Bitcoin security, accessibility and storage are trustworthy," Kelley said.

'A turning point'

Earlier, the website of Tokyo-based bitcoin exchange Mt. Gox went offline in a major blow to the crypto-currency, which shed more than 20% of its value on 25 February.

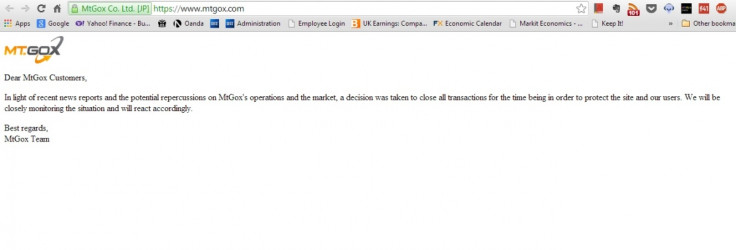

The website posted notice of its decision to close all transactions for the time being, releasing a statement which read:

"In light of recent news reports and the potential repercussions on MtGox's operations and the market, a decision was taken to close all transactions for the time being in order to protect the site and our users.

"We will be closely monitoring the situation and will react accordingly."

"We should have an official announcement ready soon-ish. We are currently at a turning point for the business. I can't tell much more for now as this also involves other parties," Mt. Gox CEO Mark Karpeles, who resigned from the board of the Bitcoin Foundation earlier, told Reuters in an email.

The shutdown comes after an internal Mt. Gox document leaked by bitcoin entrepreneur Ryan Selkis said the exchange was victim to a cyber-attack that went unnoticed for years.

"At this point 744,408 bitcoin are missing due to malleability-related theft which went unnoticed for several years. The cold storage has been wiped out due to a leak in the hot wallet," the document said.

The document claimed that Mt Gox could go bankrupt at any time. The stolen bitcoins represent about 6% of the 12.4 million in circulation.

© Copyright IBTimes 2025. All rights reserved.