Church of England 'Not Telling Truth' About Deficit in Pensions Scheme

A leading pensions expert has written a letter to the Archbishop of Canterbury to warn him that the deficit in the Church of England's pension fund is much worse than previously thought.

Pensions expert John Ralfe said a previous estimate of £293m (€355.3m, $481.4m) deficit in the CoE's Clergy Pension Scheme is an understatement.

The Clergy Pension Scheme has 16,400 members, including 5,800 pensioners and has been using a method to calculate pension contributions which has disguised the size of the deficit Ralfe told IBTimes UK.

"They [CoE] are not telling the truth, the whole truth and nothing but the truth. I think what the church should be doing now is to say right: let's have another valuation done on the basis that is required by all pension schemes in the land bar us the Church of England. They should do it on the same basis as everybody else and see where they end up," said Ralfe.

Virtually all companies that sponsor pension schemes are consistent about their valuations, taking account of yields on corporate bonds against liabilities.

The CoE is not a company, does not have shareholders and therefore does not have to report its accounts in the normal way, noted Ralfe.

"This goes back almost five years now and they have not taken a great deal of notice. This is not the first time I have looked at this and they did not take a lot of notice," he said.

The Clergy Pension Scheme's deficit would have been much higher - as much as £391m - had it not been for a jump in the discount rate used to calculate the scheme's liabilities.

The Clergy Pension Scheme increased this rate by 0.5% without giving an explanation for why this was appropriate, according to Ralfe.

Had the actual deficit had been recognised at £391m, then cash-strapped dioceses and parishes would be forced to shell out £90m a year to provide vicars and other church officers with pensions, compared with the 2012 outlay of £69.4m.

Ralfe said it was time the church came clean about its pensions deficit.

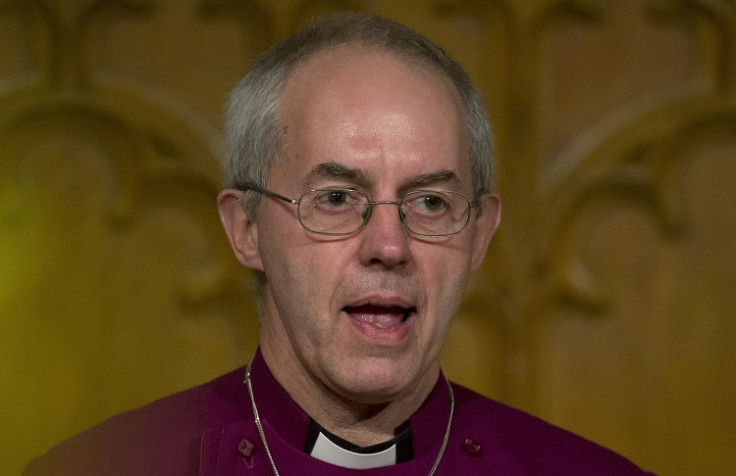

"They should do it on an open and transparent basis, particularly since Justin Welby has set out his stall on the lines of transparency and openness in financial reporting and he is on the parliamentary banking standards committee."

CoE's Response

The Church of England provided IBTimes UK with the following statement in response to Ralfe's extensive claims:

"Ralfe's claim that there is a big hole in the clergy pension scheme is simply inaccurate. At the last valuation of the scheme, on 31 December 2012, the funding deficit was 25%, and we are on target to be fully funded over the next decade. Had the valuation been carried out at the end of 2013, we might have expected the funding deficit to be closer to 15%.

"Ralfe says that the clergy pension scheme's discount rate was increased by 0.5% without an explanation. The pensions board made the assumptions for the valuation based on their assessment of the strength of the responsible bodies' financial covenant, the fall in yields on fixed interest gilts, market expectations for future RPI inflation and up to date mortality expectations. The discount rate is in line with advice from an independent actuary and with the requirements of the pensions regulator.

"Ralfe has raised these sorts of issues in the past, but has refused numerous offers by the Church of England Pensions Board to meet to discuss this matter.

"Our return-seeking funds have returned 20.8% over the three years to the end of 2012, and provisionally, 27.7% over the three years to 2013, improving the funding position of the scheme.

"Ralfe also fails to take into account that, unlike most other defined benefit schemes, this scheme is still quite immature and is still open to new members giving it a healthy contribution inflow. A bond heavy investment policy is not normally seen as either necessary or desirable for relatively immature schemes, and would make them unnecessarily expensive."

© Copyright IBTimes 2025. All rights reserved.