Eritrea Dictatorship Extorts Millions of Pounds in 'Diaspora Tax' Scam [VIDEO]

New video evidence exclusively obtained by IBTimes UK has confirmed that the Eritrean government still collects a controversial "diaspora tax" from nationals living in the UK - despite assurances by British officials that the practice has been stopped.

Secretly filmed footage inside the Eritrean embassy in London shows one Eritran, known as Simon T, who fled the secretive Horn of Africa state in the early 1990s and has lived since in Britain, was forced to pay the 2% income tax from the moment he was employed with an insurance company in Romford, Essex.

The taped interview with an embassy official demonstrates that those such as Simon T who have not required consular services for several years are required to pay "arrears" for the years in which they did not pay the tax.

"It's extortion, especially with the dictatorial government that we have in Eritrea, run by one man, with no election and no rule of law," Simon T, who is in his early 30s, told IBTimes UK.

"In Eritrea you cannot even ask if your loved ones are in prison because you are going to be locked up as well," he claimed.

The collection of a 2% income tax on Eritrean nationals living abroad violates UN resolution 2023 which condemns Eritrea's use of the tax to "destabilise the Horn of Africa region and to violate the sanctions regime". Some of the money is used to procure weapons for Islamic militants.

The UN Security Council hardened sanctions against Eritrea in December 2011 over its alleged support for Islamist militant groups such as Somalia's al-Shabaab.

Whitehall officially supports a series of UN resolutions imposing sanctions against Eritrea.

The Foreign and Commonwealth Office (FCO) had earlier sought to curb Eritrean diplomats who were collecting the tax in the UK from up to 40,000 refugees in the UK on the grounds that the money was used by the Eritrean government to destabilise the region.

In May 2011, the Eritrean ambassador in London was informed that the collection of the tax could be unlawful and breach the Vienna Convention on Diplomatic Relations. The Foreign Office told the ambassador to stop all activities relating to its collection.

But in July 2013 a special investigation by IBTimes UK, supported by hard evidence such as order transfer order slips and payment confirmation, revealed that it was still happening in Britain.

Eden (not her real name) was forced to pay thousands of pounds in diaspora tax after authorities threatened her parents in Asmara that their family business licence would not be renewed.

The FCO told IBTimes UK at that time: "We are aware of allegations over the use of harassment to collect revenue from members of the Eritrean diaspora in the UK.

"On 20 December, 2012, FCO officials raised these concerns with the Eritrean ambassador and reminded him of UN Security Council resolution 2023. [The UK supports the resolution] which condemned Eritrea's use of the diaspora tax to destabilise the Horn of Africa region and decided that Eritrea should cease using illicit means to collect the tax," the spokesperson said.

The new evidence

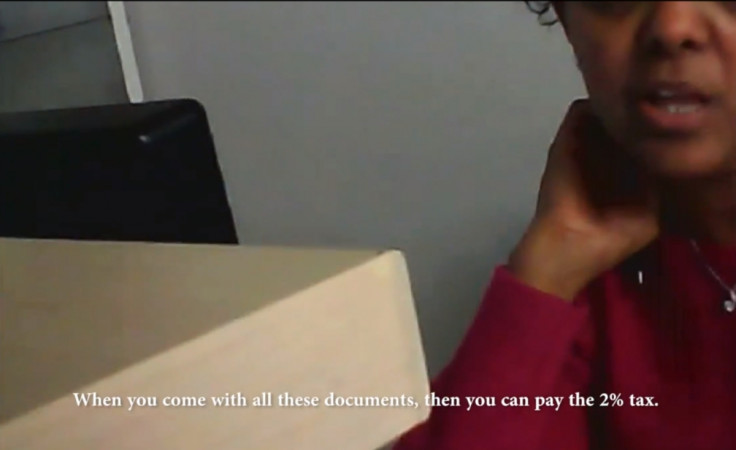

The fresh video, which was filmed with a hidden camera on 18 December 2013 in premises at 96 White Lion St. – the north London site of the Eritrean embassy – clearly displays an exchange between Simon T and an embassy official over the 2% tax. The tax is mentioned in the video.

The Eritrean-British national is asked why he had not paid the tax since he turned 18 in 1996. In reply, Simon says that he was a student until 2001, when he finished university.

He is then asked to bring proof of education:

Embassy official: OK, you know you were under age until 1996 and then from then until 2001, in education. Proof is needed of if you were under social services and so on.

Simon T: Well, I was under social services from 1995-97 but not after that. I was living in a children's home

EO: OK, from 1996-2004 what were you doing? Were you working, studying? You have to bring proof. Anyway, even if you were a student, £50 a year is paid by everyone. For the rest, until 2013 you have to provide proof of income.

Before 1996, you don't need to. However, after and until 2013 you need to bring a payslip, a P60 or anything that indicates your income. When you come with all these documents, then you can pay the 2% tax.

The total amount that Simon T has to pay ranges from £5,000 to £10,000, which has to be remitted directly to Eritrean banks.

Several Eritreans have described the tax as a "consular service" for any citizen wishing to renew their passport or Eritrean holders of foreign passports requesting a visa to visit Eritrea. Every national must produce documentation of the tax payments they made in their host country and on this basis the 2% tax is calculated.

Without the tax certificate, it is impossible to get a passport renewed or an entry or exit visa. It is also impossible to undertake a number of unofficial transactions, such as remitting the money back to the families or simply sending old clothes.

Torture, arbitrary detention and severe restrictions on freedom of expression are routine in the so-called "North Korea of Africa".

Mandatory military service imposed on all men and women between 18 and 55 is one of the main causes of flight from the country.

It has been calculated that 4,000 Eritreans leave the country every month.

"Every Eritrean family has sacrificed brothers, sisters, aunties and uncles. This is not what we dreamed for our country," Simon, who is father of two girls, said. "I can't let this happen in England."

"If we can stop this financial aid starting from here we will have a change," he said.

© Copyright IBTimes 2025. All rights reserved.