Is It Time to Invest in L.A.B. Putters? Brand Popularity Soars After $200 Million Buyout Following US Open Buzz

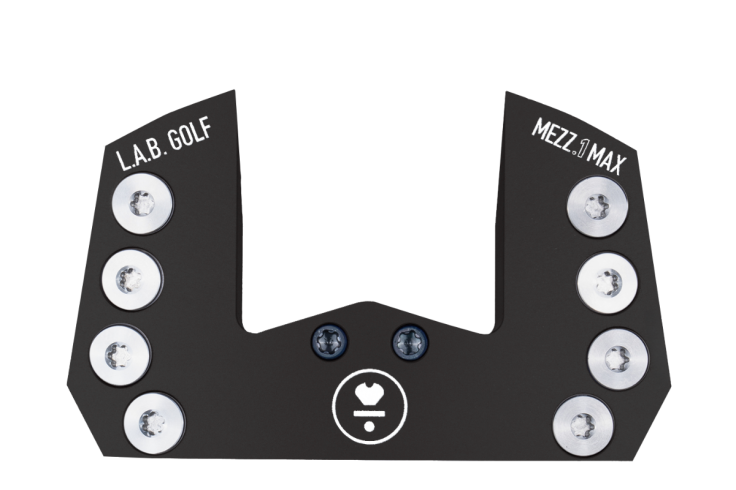

The company's innovative designs, including models like the Directed Force, have drawn endorsements from players like Adam Scott, driving a demand surge.

L.A.B. Golf, a niche putter manufacturer, has seen its brand popularity skyrocket after a £152 million ($202 million) acquisition by private equity firm L Catterton, fueled by JJ Spaun's US.

With sales projected to triple from 130,000 to 400,000 units this year, investors and golf enthusiasts are asking whether L.A.B.'s market surge signals a prime investment opportunity or a fleeting trend in the £3.8 billion ($5 billion) global golf equipment market.

US Open Victory Sparks Demand

L.A.B. Golf's lie angle balance technology, which ensures putters stay square during swings, gained global attention when JJ Spaun sank a 64-foot putt to win the US Open, according to the Wall Street Journal.

'Best night's sleep I've had in seven years,' L.A.B. Golf CEO Sam Hahn told Golf Digest in June 2025, boosting L.A.B.'s visibility.

Posts on X from @JoePompliano note, LAB Golf is on pace to triple annual sales — from 130,000 units to 400,000, after JJ Spaun won the US Open using one of their putters.

The company's innovative designs, including models like the Directed Force, have garnered endorsements from players such as Adam Scott, driving a surge in demand.

Additionally, the global golf equipment market is expected to grow at a 5% annual rate from 2023, according to Grand View Research, signalling room for L.A.B.'s expansion.

L Catterton's Strategic Investment

L Catterton, backed by LVMH, acquired a majority stake in L.A.B. Golf, valuing the company at over £152 million ($200 million), per Golf Digest.

CEO Sam Hahn, who remains in his role, refused to make any statement about the acquisition to a Wall Street Journal interview. The deal targets the expansion of L.A.B.'s direct-to-consumer model, offering putters at £380–£532 ($507–$710), bypassing retail markups.

X posts from @WSJ note, 'L Catterton bought a majority stake in L.A.B. Golf at a valuation over $200 million.'

Unlike Callaway's £99 million ($131 million) acquisition of Odyssey in 1997, L.A.B.'s deal reflects its niche innovation. Still, its private status limits investment to high-net-worth individuals via L Catterton funds or LVMH stock.

L.A.B.'s Manufacturing Innovation Fuels Scalability

L.A.B. Golf's custom fitting process, which tailors putters to individual swings using proprietary technology, has set it apart in the £3.8 billion ($5 billion) golf equipment market, per Golf Digest.

'When he made that four-footer on 17, like that was not an easy putt,' said founder Sam Hahn in a 16 July Golf Digest interview.

By producing putters in-house in Oregon, L.A.B. maintains quality control, enabling rapid scaling to meet demand after acquisition.

This focus on precision manufacturing supports its projected growth to 400,000 units by 2025; however, reliance on custom orders could strain production if supply chains falter.

Opportunities and Risks for Investors

L.A.B.'s brand momentum is undeniable, but its private ownership poses challenges for retail investors. The post-pandemic golf boom, with 3.2 million new U.S. golfers expected in 2024, supports L.A.B.'s growth, according to the National Golf Foundation.

However, relying on celebrity-driven sales carries risks, as market share battles intensify with Titleist and Odyssey. 'Hopefully, we opened a few eyes to the possibilities and quieted a few critics,' CEO Sam Hahn said in Forbes.

L Catterton's investments in Peloton and Restoration Hardware suggest a focus on scaling, but past golf brand acquisitions, such as Callaway's, have faced integration hurdles.

With L.A.B.'s sales projected to reach £91.2 million ($121 million) in 2025, up from £30.4 million ($40 million), according to ainvest.com estimates, its trajectory is strong; however, investors must weigh the volatility of golf equipment trends.

© Copyright IBTimes 2025. All rights reserved.