Jupiter Fund Management Expects Volatility to Impact Sentiment

Jupiter Fund Management, an investment holding company, expects the financial markets to remain volatile and flows subdued; it continues to believe in the long-term growth prospects for the savings market.

The group is scheduled to release its preliminary results on 7 March and it remains focused on delivering strong fund performance for its clients and investing in its business to capitalise on these opportunities when sentiment improves.

Despite the current economic headwinds and deteriorating public and household finances across the eurozone and the UK, Jupiter is confident of its ability to access opportunities across the asset management sector.

The offshore multi-manager and mutual funds company believes in focusing on medium-term opportunities, both in regard to investment opportunities for clients and the way it manages and grows its business. The group remains confident of the long-term drivers of growth for the savings market and its ability to access these opportunities on behalf of investors and shareholders.

In January 2012 the group's assets under management increased to £22.8 billion in the three months to 31 December, 2011 with cumulative net inflows of £746 million and net outflows of £225 million. A positive net cash balance sheet position is anticipated for full year results.

For Jupiter which invests the bulk of its assets in equities, and counts the UK investor as its core customer base, the fourth quarter marked the end of a run of consecutive periods attracting more money than it lost. The firm, which runs 22.8 billion pounds in assets and is headed by chief executive Edward Bonham Carter, said the poor environment for retail sales and the loss of a single segregated mandate from an institutional client resulted in 225 million pounds of redemptions.

Analysts from JP Morgan reduced their 2012 estimates to reflect weaker expected client flows over the next six months. "This leaves Jupiter's profits flat year on year, a relatively good outturn in a sector where we expect most companies to report declining profits this year," they said in a note.

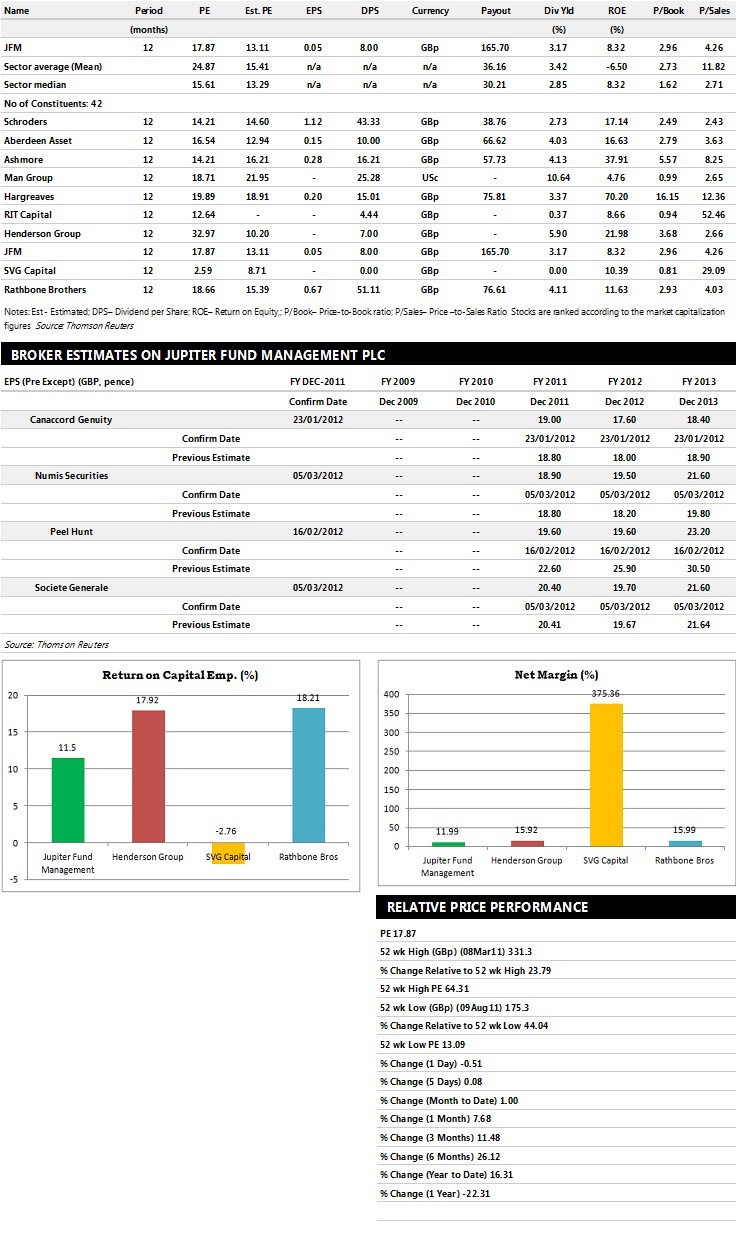

Brokers' Views:

- Societe Generale gives 'Hold' rating on the stock

- Numis Securities recommends 'Buy' rating with a target price of 305 pence per share

- Peel Hunt assigns 'Buy' rating with a target price of 300 pence per share

- Credit Suisse recommends 'Hold' rating

Earnings Outlook:

- Societe Generale estimates the company to report revenues of £292 million and £288 million for the FY 2011 and FY 2012 respectively with pre-tax profits (pre-except) of £69 million and £66 million. Profit per share is projected at 20.40 pence for FY 2011 and 19.70 pence for FY 2012.

- Numis Securities projects the company to record revenues of £243.10 million and £250.20 million for the FY 2011 and FY 2012 respectively with pre-tax profits (pre-except) of £117.20 million and £120.10 million. Earnings per share are estimated at 18.90 pence for FY 2011 and 19.50 pence for FY 2012.

- Peel Hunt expects Jupiter to earn revenues of £249.20 million and for the FY 2011 and FY 2012 respectively with pre-tax profits (pre-except) of £122.70 million and £121.40 million. EPS is estimated at 19.60 pence for FY 2011 and FY 2012.

Below is a summary of sector comparisons in terms of price earnings, earnings per share, dividend per share, dividend yields, return on equity and price-to-book ratio. The table explains how the company is performing against its peers/competitors in the sector. The table below represents ten companies based on market capitalisation.

© Copyright IBTimes 2025. All rights reserved.