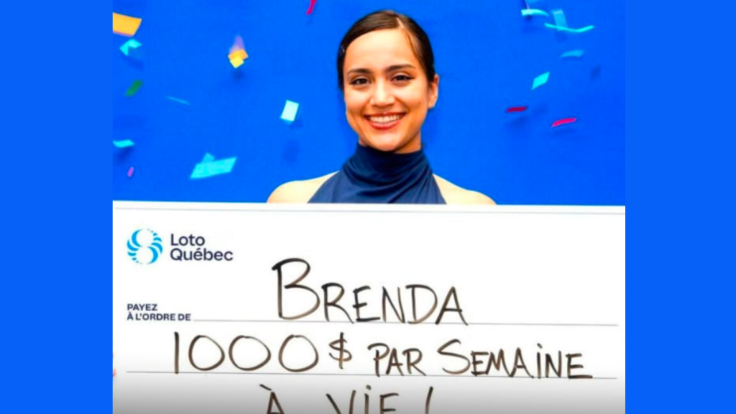

20-Year-Old Wins Lottery, Chooses $1,000-a-Week For Life Over $1M Lump Sum — Would You Do The Same?

A 20-year-old woman from Quebec has reportedly opted for a $1,000 (£730) weekly annuity for life rather than a one-time $1 million (£730,000) payout after winning the province's Gagnant à vie lottery.

The decision, revealed in September 2025, has ignited debate about whether guaranteed income or a lump sum offers the smarter long-term choice.

What Happened

According to reports from Yahoo Canada, Brenda Aubin-Vega, aged 20, secured the top prize earlier in September 2025.

Instead of taking the one-time $1 million (£730,000) payout, she is said to have opted for the weekly annuity worth $1,000 (£730), which would continue for the rest of her life.

She allegedly explained her choice by saying the steady income would help her manage long-term financial goals such as saving for a future home. The case quickly sparked discussion online, with some praising her decision as sensible and others questioning whether the lump sum might have offered more freedom.

How the Lottery Works

The Gagnant à vie game, operated by Loto-Québec, has been running for decades and remains one of the most popular scratch-off tickets in the province. The top prize gives winners two options: a lifetime annuity of $1,000 per week or a lump sum of $1 million.

Loto-Québec confirms the rules are standard and the weekly annuity is tax-free. However, the corporation has not yet published an official press release naming Brenda as a confirmed winner. That detail means reports remain based on secondary coverage, not direct verification.

Over the years, past winners have split on whether to take the annuity or the lump sum. For younger players, the weekly option often exceeds the value of $1 million if they live several decades, while older winners tend to choose the immediate payout.

Why It Matters

The story highlights a common dilemma faced by lottery winners: security versus flexibility. Financial advisers note that a guaranteed weekly income provides stability and can remove the temptation to overspend. However, critics argue that inflation could reduce the real value of $1,000 a week in the long term.

The case has also generated cultural interest, partly because Brenda is reported to be just 20 years old. A lifetime annuity at such a young age could, in theory, deliver more than $3 million over six decades. Yet some argue the lump sum, if invested wisely, might offer faster growth and more control.

The reported win also reignites debate about whether lottery announcements should be more transparent. Loto-Québec often issues public statements about major winners, and until that happens in this case, questions remain about the specifics.

What Comes Next

If confirmed by Loto-Québec, Brenda would join a select group of Gagnant à vie winners whose decisions spark financial debates. Her choice could be cited in future discussions about how younger generations view security, risk, and wealth management.

For now, the story remains based on media reports rather than an official announcement. Whatever the final details, the Gagnant à vie lottery continues to spark fascination not just for its prizes but for the life-changing decisions it forces winners to make.

© Copyright IBTimes 2025. All rights reserved.