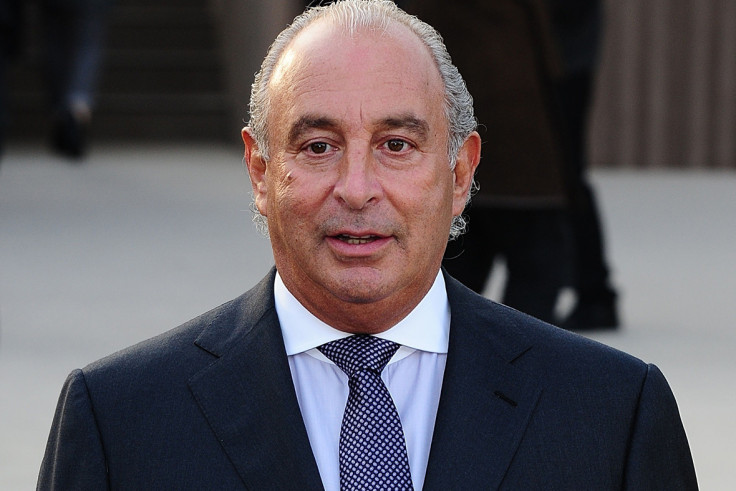

Did Philip Green get off lightly with £363m BHS settlement?

Deal will not restore retirement income promised by bust BHS pension scheme but offers some relief.

Former employees and pensioners, parties to insolvent retailer BHS' pension fund can finally breathe a sigh of relief. In a long overdue settlement with the pensions regulator, tycoon Sir Philip Green who owned and then sold the troubled retailer for a quid to owners of dubious repute, agreed to give £363m of his own money to the pension fund.

However, the argument that Green got off lightly does strike a chord. For starters, the pension fund had a shortfall of £571m following the collapse of the retail giant in 2016. Prior to its demise, Green took £400m out in dividends from the beleaguered retailer before selling it on to the hapless, twice bankrupt, Dominic Chappell for £1 in March 2015.

While it would represent an oversimplification of a complex argument, so assuming Green pocketed £400m and gave back £363m, that still leaves him richer by £37m, along with hypothetical interest or investment gains from the proceeds. Could be losses, we just do not know.

Furthermore, the said amount given by him to the pensions regulator represents only 10% of his net worth using data available from 2015. By that argument, Green could, and perhaps should have done more.

Finally, for all intents and purposes, Green's move is being described as a "voluntary arrangement" which many critics, to their utter dismay, suspect would save his knighthood.

Reflecting on the events of the last 12 months, Green said: "I would like to apologise to the BHS pensioners for this last year of uncertainty, which was clearly never the intention when the business was sold."

Legal opinion on the 'billionaire spiv'

The apology and settlement were long overdue, and moments of belligerence from Green, accompanied by a prolonged face-off with the political classes made the outcome BHS pensioners now have seem unlikely at times.

Yet being pragmatic, the settlement is better than anyone could have hoped for. A sample market opinion based on the views of 11 legal specialists analysed by IBTimes UK suggests almost none of those we surveyed expected any more than £250m, had the regulator and Green gone down the legal route. Legal fees would have depleted the settlement account further.

Those in legal circles we have spoken to also opined that Green opted for at least £100m premium to what the regulator would have secured via legal means to perhaps "save his knighthood". In which case, badgering from the political classes - with some Members of Parliament labelling him a "billionaire spiv" - did the trick.

It does appear Prime Minister Theresa May considers the matter closed. "We welcome the fact that the pensions regulator has agreed a settlement with Sir Philip Green. This a positive outcome which will bring peace of mind to the 19,000 BHS pensioners who have endured a period of uncertainty since the company collapsed."

Veteran MP Frank Field who had several sparring matches with Green in the wake of BHS' collapse, and was among the tycoon's most strident critics, said the gesture on the latter's part was welcome.

"This out-of-court settlement by Philip Green is an important milestone in gaining justice for BHS pensioners and former workers that we [parliamentarians] have been pushing for since the beginning our inquiry into BHS' collapse."

What next for BHS pensioners and former employees

So here is the nitty-gritty for BHS pensioners and former employees. The settlement, will of course, not fully restore the retirement income guaranteed by the now defunct BHS scheme.

Of the 19,000 holders, around 7,000 retirees will face at least a 10% reduction in their earnings, which would be some comfort given many were resigned to zero returns. These members would also be offered £18,000 as a lump sum amount.

Similar contribution parameters apply to the 12,000 pension scheme holders or those of working age. Alternatively, they could also transfer to what would be a newly established BHS pension scheme, where £243m of Green's settlement amount would be deposited, and restore their pensions provisions.

Admittedly, there is still a £200m black hole from the old pension settlement, but all things considered this is the best outcome many could have hoped for.

Gaurav Sharma is the Business Editor of IBTimes UK. He has been a financial journalist for over 15 years, with a core specialisation in macroeconomics and commodities. Follow Gaurav on Twitter.

© Copyright IBTimes 2025. All rights reserved.