Edmung Shing: Secret Santa's festive stock tips including SuperGroup, Close Brothers and easyJet

With annual New ISA allowances now raised by the government to £15,000 per tax year (to 6 April), and cash savings rates no better than 1.5% on the high street, investing in stocks seems an obvious destination for any long-term ISA-bound savings.

With the potential for the traditional year-end Santa Claus rally close at hand after what has been a turbulent last couple of weeks, which stocks should you consider for your ISA?

Focus on mid-cap gems

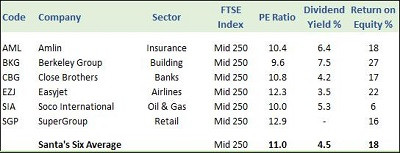

Over the long-term in the UK stock market, mid-caps - the FTSE Mid 250 index - (fig.1) have far outperformed the largest companies such as Vodafone, Royal Dutch Shell and HSBC (FTSE 100 index).

So I have focused on mid-cap gems of companies drawn from different industries, all with appealing value, attractive dividend yields and high profitability; all factors that have been proven to lead to outperformance over the long-term (data kindly supplied by Stockopedia.com).

Amlin (fig. 2) offers non-life and reinsurance underwriting in the Lloyd's of London market.

It has a very strong record of profitability over the last 10 years, consistently holding or raising its dividend each year.

What makes Amlin even more interesting is its dividend yield exceeding 6%, plus the fact that one of its Lloyds counterparts, Catlin has just been boosted by a takeover bid from XL Group.

With Lloyd insurers the subject of merger and acquisition activity, Amlin may also become a target in time.

Berkeley Group (fig. 3) is a residential house builder focusing on London and the south east, benefiting from recent strong house price inflation in and around the metropolis over the last year or so.

The traditional spring time UK house price pick-up should lift Berkeley next year, not to mention the benefit to housing demand from effective lowering of the stamp duty burden on house sales under £937,000. This supports a very high 7.5% dividend yield, backed by £150m of net cash on its balance sheet.

Close Brothers (fig. 4) is a UK-based merchant bank offering a range of services to both business and private clients, as well as broking services and asset management.

The current growth in new stock market listings is a very positive trend for the company, while the company's book value has grown steadily over the last six years, the mark of a strong banking business model.

Close Brothers should benefit from strong economic growth, allowing them to grow their business loan book.

Easyjet (fig. 5) has been a prime beneficiary of the boom in low-cost airline traffic throughout Europe over the past few years.

The recent collapse in oil prices represents a future boost to profitability, as fuel accounts for a large slice of any airline's costs.

Easyjet has carried increasing numbers of passengers at higher passenger yields, resulting in impressive growth in earnings since 2012, which should continue out to 2016 as it focuses increasingly on capturing more European business travellers.

Soco International (fig. 6) is an oil exploration and production company with widespread interests in countries including Vietnam and the Republic of Congo.

It is rare among its oil and gas peers in boasting very steady oil production volumes, a superstrong balance sheet with $284m of net cash and the ability to easily support a robust 5.3% dividend yield from its surprisingly stable earnings stream.

A crude oil price recovery would be a key catalyst for Soco, with Brent back down at $61/barrel versus a June high of $115/barrel.

SuperGroup (fig. 7), the retailer of the Superdry fashion brand, has seen its share price fall from a high of over £17 to less than half of that today, as like-for-like sales growth has gone into reverse (-4% as of the latest interim results).

In spite of that, SuperGroup should achieve revenue growth of 10% of more over the next two years, with the potential to see even higher profitability as it raises gross margins.

And yet, the company's shares are only valued at 12 times next year's profits, a bargain given the expected revenue growth rate.

These six mid-cap gems offer a rare combination of attractive value, high dividend income and are all very profitable, a potent combination offering substantial upside for 2015.

© Copyright IBTimes 2025. All rights reserved.