Edmund Shing: UK house prices, stocks and bonds are too expensive so look to AIM and Asia

Professor Robert Shiller is not only a surprisingly self-effacing and modest man (for someone who has won the Nobel Prize for economics), he is also generally worth listening to.

After all, he was the author of the seminal book Irrational Exuberance first published in 2000 at the height of the dotcom boom, where he warned how stock markets at the time were overvalued. He was subsequently proved right, with markets falling by about 50% from late 2000 to early 2003.

Then he published the second edition of his tome in 2005 covering the housing bubble in the US. Guess what? In 2006, the US housing market then hit a peak and started declining, triggering the Global Financial Crisis of 2008.

Now, Shiller is warning all major financial markets – shares, bonds and property – are all overvalued. This is a situation we have never seen before.

According to him, even during previous bubble periods such as 2000 or even further back before the Wall Street Crash of 1929, usually only one financial market (either stocks or property, for instance) were drastically overvalued, while others (such as bonds) weren't. This time around, they are all expensive in his eyes.

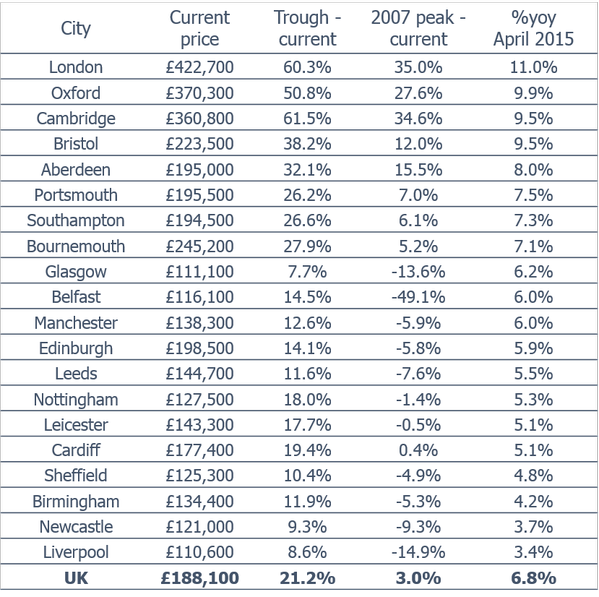

We only need to look to London house prices (Figure 1), which have gained 140% over the past 13 years, for evidence of widespread bubbles and overvaluation. According to the Nationwide building society, the average London house (at £422,700) is already three times more expensive than in England's second city, Birmingham (£134,400).

Everything is expensive – should we be worried?

According to Shiller, all financial markets are expensive because we are all afraid after the last financial crisis and are saving more because we are so uncertain about our financial futures.

This is pushing up the price of all assets, as there are so few options for investing our money to get a high return. Looking at the UK as an example, there are very few places where we can save money in a bank or building society savings account to get even a very modest 2% rate of interest. Indeed, according to the Swanlow Park website, the average bank branch instant Isa savings rate has hit a new historic low of only 1.4% (Figure 2).

You might be able to get a slightly higher interest rate by shopping around but only if you agree to have access to your money exclusively via the web.

What can we do? Save more

Shiller's main conclusion is that we should all save more, as our portfolios of shares, bonds, cash and property probably won't do as well as we imagine. So we will need to save more to make up any shortfall thanks to lower actual returns on our investments.

There are still a number of stock markets around the world that look relatively cheap and which are also still showing profit growth. So these could be good places still to invest in.

1. The UK AIM index of very small-cap stocks

The AIM index of small stocks has not kept pace at all with the FTSE 100 index of leading UK stocks since March 2014; since then, the FTSE has risen 4% while the AIM segment of the stock market is 13% lower today than back then (Figure 3). So this is potentially one good hunting ground for investors.

A word of warning, though. AIM stocks can prove very volatile, so you might be better served with a fund that groups together a range of very small-cap companies, such as Miton's Diverse Income Trust investment trust (code: DIVI).

This investment trust can be bought on the stock market via a share trading account like a stocks and shares Isa that invests heavily in AIM-listed small companies such as shoe retailer Shoe Zone and PVC double-glazed window maker Safestyle.

2. The Japanese stock market

This is still cheap in valuation terms and continues to benefit from a weaker Japanese yen (boosting exporters) and ongoing support from the Bank of Japan.

One of my favoured ways to buy Japanese stocks is through an ETF: the iShares MSCI Japan hedged ETF (code: IJPH). This exchange-traded fund allows you to buy exposure to Japanese stocks and benefit from the weakening yen, while investing in pounds sterling.

3. The Hong Kong stock market

For those tempted to play the long-term growth story in China but who are worried about the strong run-up in mainland Chinese stock markets in 2015, it may be worth looking at Hong Kong shares in the territory's Hang Seng index.

These stocks, largely property stocks, banks such as HSBC and Hang Seng Bank, and conglomerates such as Hutchison Whampoa (owner of the Three mobile phone network) are much cheaper in valuation terms than the mainland Shanghai and Shenzhen stock market indices.

Invesco PowerShares offers a Hong-Kong focused ETF, the PowerShares FTSE RAFI Hong Kong China UCITS ETF (code PSRH), which contains the largest companies in Hong Kong's Hang Seng stock market index.

Edmund Shing is the author of The Idle Investor (Harriman House), an expert columnist and a global equity fund manager at BCS AM. He holds a PhD in Artificial Intelligence.

© Copyright IBTimes 2025. All rights reserved.