What does ARM's £24bn deal with SoftBank mean for UK tech industry?

SoftBank's acquisition of Cambridge chip-designer ARM could be just the start of UK tech-takeovers.

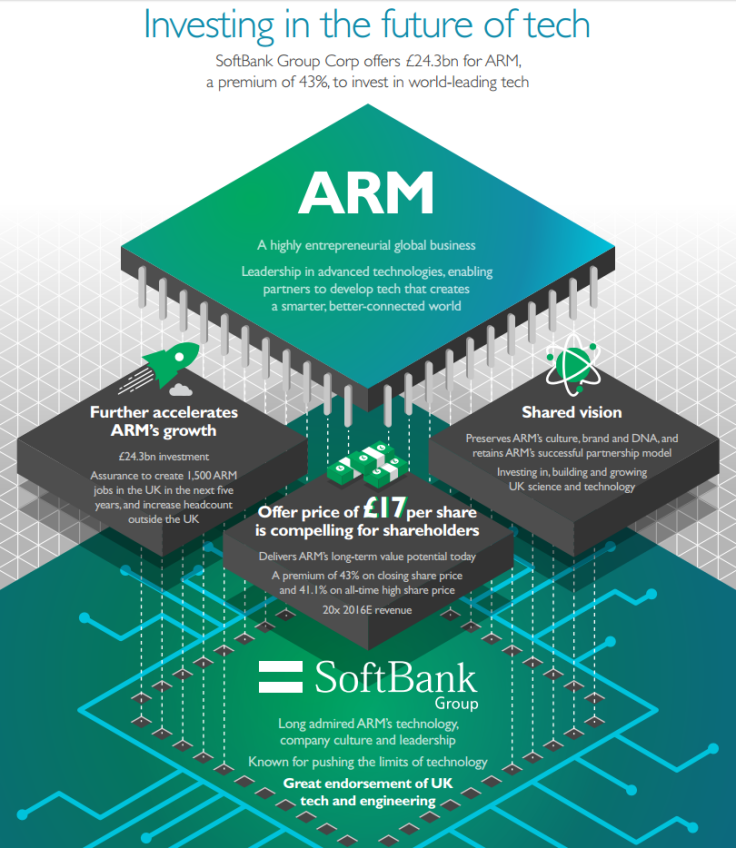

Another day, another leading UK company acquired by overseas investors. Cambridge-based ARM is being bought by Japan's SoftBank tech conglomerate for £24.3 billion, almost twice the amount paid for the UK's other tech star, Autonomy.

Under the all-cash, agreed offer, SoftBank will pay £17 per ARM share − a premium of more than 40% on Friday (15 July)'s close. Philip Hammond, the UK's new chancellor of the exchequer, was quick to claim this as a victory for Brexit. "Just three weeks after the referendum decision, it shows that Britain has lost none of its allure to international investors," he said in a statement, suggesting the UK's post-Brexit industrial strategy might be a fire sale to cash in on the Brexit-inspired collapse in sterling. Toss another chair leg on the fire.

What does this mean for rest of UK's tech industry?

Cynics might well ask "what tech industry?" but there are a number of up and coming tech companies. None with the global footprint of these three but plenty to be excited about. Instead focus will now shift to the next generation of start-ups where the UK is building an impressive, if still immature, portfolio.

The last government pinned its hopes on establishing the UK not as just a hub, but rather the global centre for fintech − innovation around the financial industry. A combination of London's historic role and a responsive and smart regulator saw the sector building momentum. But Brexit has cast a shadow with questions surrounding the viability of 'passporting', the pan-EU deal that allows financial institutions to operate across the 28-member union.

That isn't to say that the UK is without other options. Among the next generation of start-ups, the UK is far ahead of the rest of Europe. Of the 47 start-up 'unicorns' (billion dollar valuations) identified by tech investment bank GP Bullhound, 17 are in the UK, nearly three times as many as Sweden, the number two. However, in terms of global reach and importance, none are on the scale of ARM.

Furthermore, with sterling's weakness, those companies billing in pounds must start to look attractive to overseas investors looking to pick up bargains.

Home-grown hero

Cambridge was the home of the UK's tech industry, giving birth to three truly global, independent tech companies: Autonomy, ARM and Cambridge Silicon Radio (CSR). With the acquisition of ARM, all three have now been snapped up: CSR by US chipmaker Qualcomm last year, Autonomy by HP in a rancorous and ill-fated deal, and now ARM.

The 4,000-strong ARM traces its roots to the early days of the personal computer industry. Dr Hermann Hauser and Dr Chris Curry founded Acorn in 1978, which designed the Acorn Risc Machine (ARM) in 1984. ARM was spun out into an independent company in 1990 and changed its name to Advanced Risc Machine in a deal with Apple in which invested $1 million. When Apple sold the stake for $800 million at a time of financial difficulty, it saved Apple from bankruptcy.

ARM was that rare beast − a European tech company with a truly global footprint. Its unique business model was to design, not build, chips. Its low-power architecture when compared to the battery-sucking beasts built by rival Intel, meant it was the chip of choice for mobile devices, powering every iPhone, Samsung and pretty much every other handset in the world.

Today Intel's share of the smartphone market is a rounding error; Lenovo, the Chinese maker has remained loyal and has a few Intel-powered smartphones. Even so, Intel recently announced 12,000 layoffs.

Hauser once said the best thing it did when founding ARM was not to give it too much money. Its unique business model came about because the company couldn't afford to buy the billion-dollar "fab" plants to build their own chips and take on rival Intel head-to-head.

Instead, by licensing chip designs, it meant manufacturers were, in effect, pooling their combined knowledge. "So it's not Intel Vs ARM, it is Intel Vs every single semiconductor company in the world," he told me in an earlier interview. "Because everyone has an ARM license. They [Intel] are fighting Qualcomm, SD, Nokia, Apple."

However, life hasn't been great for ARM of late. Its share price has essentially flatlined for a year as demand for smartphones has eased off, and the company has struggled to penetrate the server market where Intel reigns supreme. Servers are high-power computers, typically collected in hundreds and thousands of units in "farms" or data centres that power the gargantuan tech companies of today like Google, Facebook, and Amazon. Intel's Xeon chips, based on the company's x86 chip architecture, drive in excess of 95% of the world's servers. Despite years of trying, ARM has struggled to gain a toehold.

The power of powering the Internet of Things

Instead the company is playing to its strengths, designing low-power chips, making it ideally placed to cash in on the predicted Internet of Things (IoT) revolution. In 2013 ARM, a notoriously parsimonious company when it came to acquisitions, acquired Sensinode, a Finland-based company that develops IoT software. Earlier this year ARM bought Apical, a company that specialises in image recognition.

Predictions about the size and scope of the IoT market are always big; some inconceivably large number of devices will be connected to the internet by some indeterminate date in the future. Big numbers look good in business presentations. But ARM's margins are going to be squeezed on the tiny, cheap chips to make your toaster smart, or give a street lamp "intelligence", compared to a smartphone.

SoftBank hopes it can use its diversity to exploit these cent opportunities. "This is one of the most important acquisitions we have ever made, and I expect ARM to be a key pillar of SoftBank's growth strategy going forward," said SoftBank Chief Executive Masayoshi Son in a statement.

What next for ARM?

SoftBank promised to double jobs in the UK over the next five years, and keep ARM's headquarters in Cambridge.

The Tokyo-based conglomerate has deals in start-ups from India to China, as well as owning Sprint in the US and a carrier in Japan. It recently sold off its stake in Finnish game maker Supercell, which is reputed to have netted the company some $7 billion. In total SoftBank has recently raised nearly 2 trillion yen through asset disposals, according to Son, including the sale of shares in China's Alibaba.

It is a business cliché (but like all clichés is founded in truth) that great companies acquire, they are not acquired. The loss of ARM, the last jewel in the UK's increasingly tarnished tech crown, may make sense for the market and the 4,000 employees, but its loss is going to smart.

New prime minister, Theresa May, had raised questions about foreign takeovers of leading UK companies. But the first flash of a chequebook has seen that policy tossed onto the fire by her chancellor. Expect more to follow.

© Copyright IBTimes 2025. All rights reserved.