New Delhi gathering offers glimpse of economic, political potential of emerging markets - without the West.

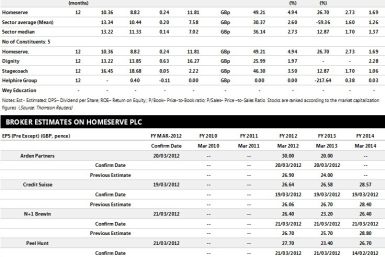

Homeserve Plc, the provider of home emergency and repair services to over 4.9 million customers internationally, has braced up to perform well for the current year and beyond by addressing the root causes behind the sales, marketing and complaints handling issues in the Britain.

ONS report estimates 0.17% rate increase in 12-month Consumer Price Index following budget.

The Office for National Statistics has revised its growth figures down for the final quarter of 2011 - to an even bigger 0.3% contraction.

Rescused holiday firm reports business hit by political unrest in North Africa

Leak of Middle East buying interest doesn't fit with market's view of state-owned bank

It has been speculated that the government is in advanced talks with Abu Dhabi investors to sell part of the state-owned bank RBS.

For some time past, articles in the national press and media programmes dealing with current affairs, have indicated that the current younger generation is unlikely to match the living standards of their parents. The Chancellor, George Osborne's latest Budget did almost nothing to change that situation though ultimately we all depend, to a greater or lesser extent, on the drive and wealth creation of those up-and-coming.

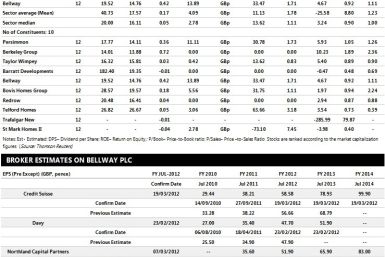

Bellway, the housebuilder, enters the second half of the year with an order book of £423 million, having already reserved or legally completed 83% of this year's target, with an expectation to reach double digit operating margin for the six months to 31 January.

Financial Times reports that plans being drawn up to float Royal Mail Group on stock market in autumn 2013.

Discount airline posts smaller-than-expected H1 loss on marketing, cost-control efforts

Shares of Sprint Nextel Corp. have been falling in recent times.

British banks are required to raise more capital at the earliest as the strength of the worldwide financial markets remains weak.

Bank of England asked the banks not to distribute huge amounts in bonuses because of the tight financial situation.

New Banking Watchdog says global financial system

Petrol prices at the pump soar over 140p with no end in sight, warn analysts.

The president of the European Central Bank insists the worst of the eurozone crisis is over, but do investors agree?

Economists expect no quick return to Britain's house price boom as mortgage lending remains subdued.

Vodafone Group streaks ahead of the FTSE 100 this week as solid newsflow supports share price

Growth remains the focus in Europe: supply concerns help boost oil prices

As consumer confidence dips and austerity bites, the UK's retail industry continues to struggle.

British gas prices fell on fears of slump in demand as much as 13 percent on Thursday below the seasonal norms and also due to weak global economic data, which drew down the wider energy complex, including British gas futures.

U.K. consumer confidence dropped in February as shoppers were more worried about their jobs and weak economic growth, according to the latest survey released from the building society Nationwide.

Investment bank's culture questioned again as more ex-employees go on the attack.

Economic data for Ireland reveals economy contracted in final two quarters of 2011 - and eurozone looks set to follow.

GSK said the chancellor's tax cut on medicine patents means they will build a new factory at Ulverston and invest more in their established sites.

The pair will develop, manufacture and sell cars in China to the country's expanding middle class as luxury car demand increases.

World's manufacturing economies showing weakness as UK high street sales fall more than forecast.

The U.K.'s public sector net borrowing increased more than anticipated in February 2012, while striking a record value for the month of February, according to the latest data released from Office for National Statistics (ONS).

Financial experts, business leaders and media pundits give their view on what chancellor George Osborne should do.