Home

> FTSE

FTSE

Rio Tinto Shares Drop as Iron and Copper Ore Production Tumbles

Weather disruptions blamed for decline as investors pull back on shares

Marks and Spencer Shares Plunge on Britain Sales Fall and Stock Shortage

Marks and Spencer has reported a drop in its UK like-for-like sales by 0.7 percent for the 13 weeks ended in March, but reported a growth in food sales by 1 percent. Analysts forecasted a rise of 0.4 - 1.6 percent.

Burberry's Investments on Stores and Infrastructure to Boost H2 Trading, UBS Raises Price Target

Burberry Group says it remains focused on implementing its proven core strategies to attain long-term growth while continuing in the demanding macro environment. The group is scheduled to release its trading update for the six months ended March 31, 2012 on Tuesday.

Slowdown in China Imports will Unsettle George Osborne's Export Plans

Chancellor plans to increase UK exports to emerging markets jeopardised by slowdown in growth.

Punch Taverns First-Half Pre-Tax Profits Slide

Punch Taverns reported a fall of 20 percent in its profit before tax for the six months ending in March at £33 million compared to £41 million a year ago. But expects expects to reap benefits during the second half of the current year from the Queen's Diamond Jubilee, the UEFA European football championship and the Olympic Games.

Hays Shares Shot Up on Q3 Net Fees Rise; Secures 'Buy' Rating from Jefferies

Hays Plc has posted a rise of 10 percent in its net fee for the third quarter and growth of 18 percent in international business, which accounts for 70 percent of total net fees.

Ashmore Group Bets on Emerging Asset Classes for Significant Profitable Growth

Ashmore Group says that it continues to innovate with an ever deepening range of up-coming market products and its infrastructure and distribution platforms are progressing to plan. The investment management services firm is scheduled to release its interim management statement on Thursday.

Mothercare Mulls International Expansion and Major Restructuring Acitvity in UK

Mothercare, as a part of its British property restructuring activity, is planning to close 111 loss making stores in town by 2013. Out of total 111 stores 76 closures will take place as leases expire and disposal of 35 loss-making stores, which will result in cash cost of £16.6 million.

Michael Page Scales Up International Expansion, Sees Robust Recruitment Activity Levels Ahead

Michael Page International stresses on plans to continue its geographic expansion in emerging markets due to many long-term growth opportunities, especially in Latin America and Asia. In spite of expansion plans it remains cautious about the current macro economic outlook.

FTSE 100 to Hit 6,100 Mark By 2012 End

Britain's FTSE 100 is expected to hit 6,100 mark by the end of 2012, driven by signs of growth in UK economy, improving European debt crisis and good global economic prospects.

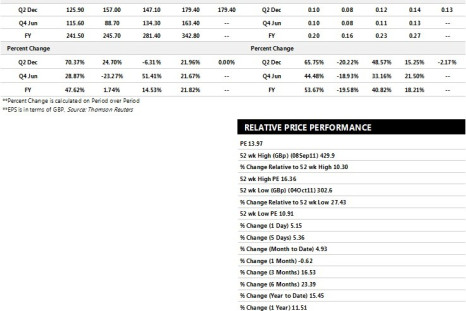

Volex Group Aims for Transformation; Added to Brokers' Buy List

Volex Group says its trading will be in line with current market expectations for the twelve months to April 1, 2012 despite increased global economic uncertainty, which resulted slow growth in Q3 FY 2012.

European Markets Extend Losses After Soft German Data

Bond yields rise, shares slump as Europe's problems appear to deepen

easyJet Reports Passenger Rise of 4.4% in March

Budget carrier says paid seats increased to 4.6 million

Beware the Bondholder: Debt Auctions in Spain, Portugal Hit Markets

Tough budgets in Iberia failed to lower borrowing costs, ECB holds key rate at 1 percent

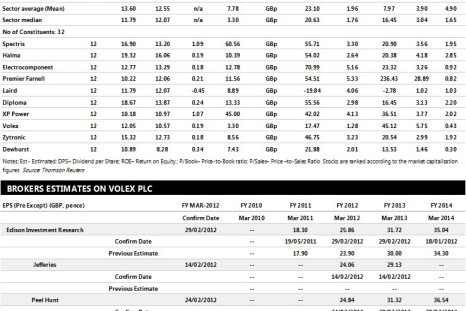

Halfords Group Expects Dip in Full-Year Gross Margins But Secures 'Outperform' Rating

Halfords Group expects its full-year gross margins to decline by 130 to 150 basis points. It says the expected decline is in line with market expectations although it is worse than the forecast at least 100 basis points given in November.The group is scheduled to release its pre-close trading update on Thursday.

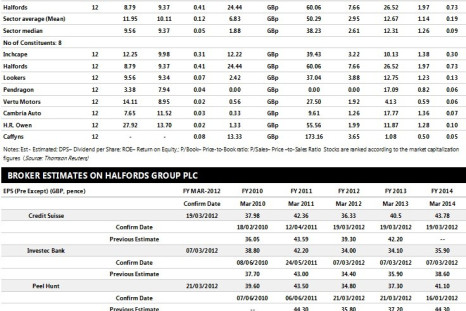

Robert Walters to Deliver Satisfactory Full-Year Performance, Optimistic on Future Growth

Robert Walters says it is well positioned to exploit opportunities through long-term investment and cost management and is committed to expand in markets which offer the best prospects for growth, its future investment plans may reflect this.

Eurozone Services Show Recession Symptoms for Economy

Activity slumps below growth mark, but outlook hits 8-month high

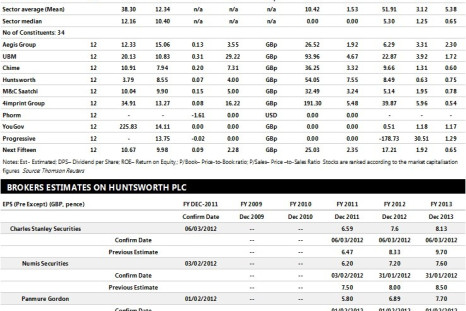

Huntsworth Shares Slump as Profit and Earnings Fall, Dividend Flat

PR and healthcare consultancy sees margin pressure in 2011, but upbeat for 2012

UK Economy: Forward-Looking Data Clashes with Lagging Indicators

British economy may be poised for sharp recovery

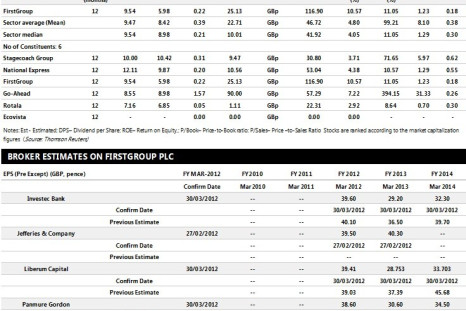

FirstGroup Commits to Dividend Growth While Profit Declines, Sees FY 2012-13 as Year of Transition

FirstGroup, the British transport operator said that its overall trading for the year ended March 31, 2012 has been in line with management's expectations and remains on track to attain overall earnings target for the year.

Huntsworth to Deliver Improved Trading in 2012 with New Business Pipeline and Longer-Term Contracts

With its new business pipeline being strong, Huntsworth Plc, the global public relations and integrated healthcare communications group, is confident of improving trading in 2012 compared to 2011 and is scheduled to report its preliminary 2011 results on Tuesday.

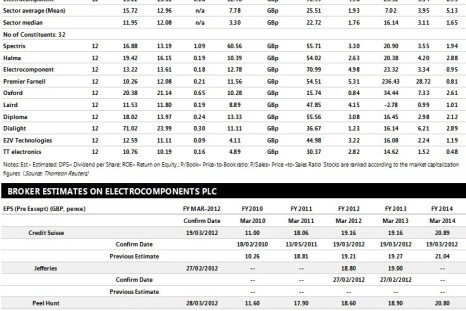

Electrocomponents Keen on Tight Cost Control and e-Commerce Initiatives to Boost FY Earnings

With the widen international businesses, established strategy and well-built balance sheet, Electrocomponents, the world's leading high service distributor of electronics and maintenance products, is investing in its planned proposals and being aware of the ongoing economic situation, it is continuing to maintain tight cost control, therefore the group anticipates current second half operating costs to be in line with the second half of FY 2011.

Hilton Food Group Full-Year Earnings Rise on Price Recovery

Despite difficult economic conditions, Hilton Food Group, has reported a rise of 13.6 percent in its full year revenue to £981.3 million, up from £864.2 million in 2010, which was driven by the new facility in Denmark and the recovery of higher raw material meat prices.

Imperial Tobacco Shares Rise as Solid First Quarter Earnings

Bristol-based company gains three percent in half-year sales.

Petropavlovsk Revenues Jump Two-Fold and Profits Rise Ten Times

Driven by an increase in gold sales by 52 percent, Petropavlovsk, the Russian gold exploration company, has reported revenue of US$1.3 billion for the full-year 2011, which is more than double the group's revenue of US$612 million in 2010.

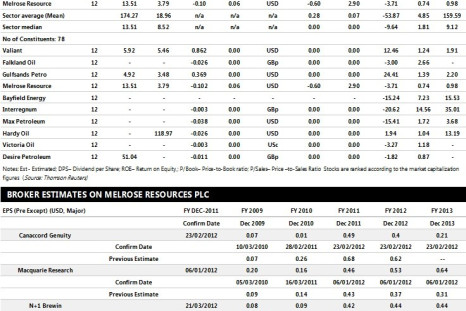

Melrose Resources Swings to Profit, Plans Debt Reduction

Oil and gas exploration group lifts earnings as Bulgarian, Egyptian fields improve

Melrose Resources Set to Leverage New Growth Opportunities in FY 2012

Melrose Resources, the oil and gas exploration, development and production company remains on track to achieve its target to reduce financial gearing to below 60 percent by this year end.

Compass Group Sees Slower Sales Growth in Europe, UK

Catering Group says challenging market conditions will slow revenue growth in first half of year

Kazakhmys' Shares Top FTSE as Group Lifts Dividend After Solid Full-Year Earnings

Copper miner lifts dividend as revenues, but cash costs remain an investor concern

Wolseley Posts First Half Profit Rise, Lifts Dividend As US Growth Quickens

World's biggest building supplies company sees US strength, but Europe slowing